Executive Summary

Mazagon Dock Shipbuilders Limited (MAZDOCK), a Navratna Defense Public Sector Undertaking with an established reputation in constructing submarines, destroyers, and frigates, has delivered impressive Q3 FY25 results. The company demonstrated solid operational metrics and indicated promising long-term growth potential supported by a secure order book, substantial backlog, and strategic capital expenditure plans aimed at expanding capacity and upgrading technology.

Key Company Metrics

Q3 FY25 Results & Performance Analysis

Revenue & Earnings Growth

The Q3 FY25 figures demonstrate robust top-line execution with revenue growth consistent with Mazagon Dock’s historical performance. The company maintained focus on order execution with significant contributions from completed projects, particularly Project 15 Bravo. Notable reversals of D-448 liabilities have additionally boosted profitability during this quarter.

Margin Performance

While current profit before tax (PBT) margins exceed industry-normalized ranges, management has provided guidance that over the medium term, normalized margins are expected to settle in the 12-15% range (PBT basis). This adjustment is anticipated as legacy high-margin orders are gradually phased out and new orders come into the pipeline.

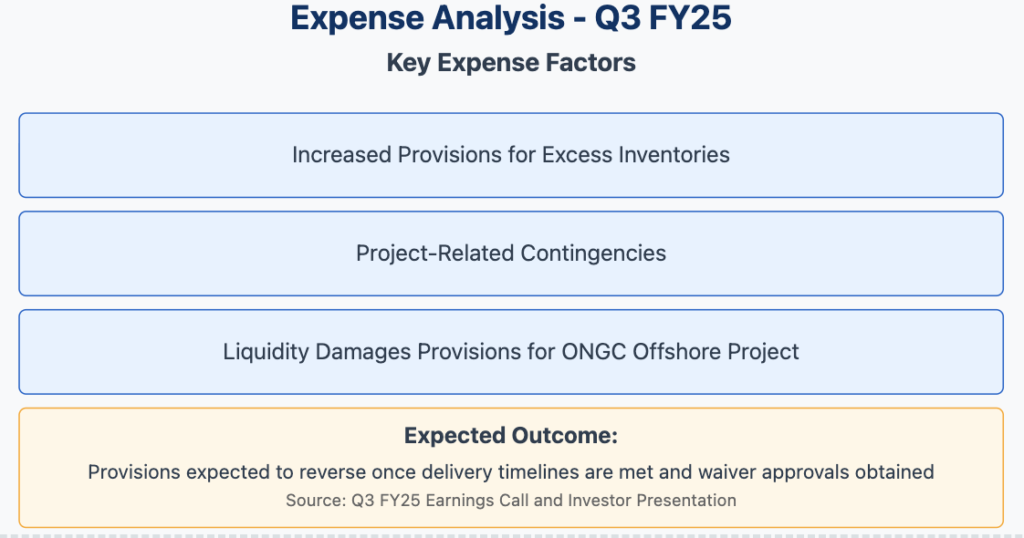

Expense Analysis

Expense Management

The company reported increased provisions during the quarter, primarily related to:

- Excess inventories

- Project-related contingencies

- Liquidity damages provisions for the ONGC offshore project

Management indicated that these provisions are expected to reverse once delivery timelines are met and necessary waiver approvals are obtained, potentially boosting future profitability.

Future Growth Plans & Expansion Strategy

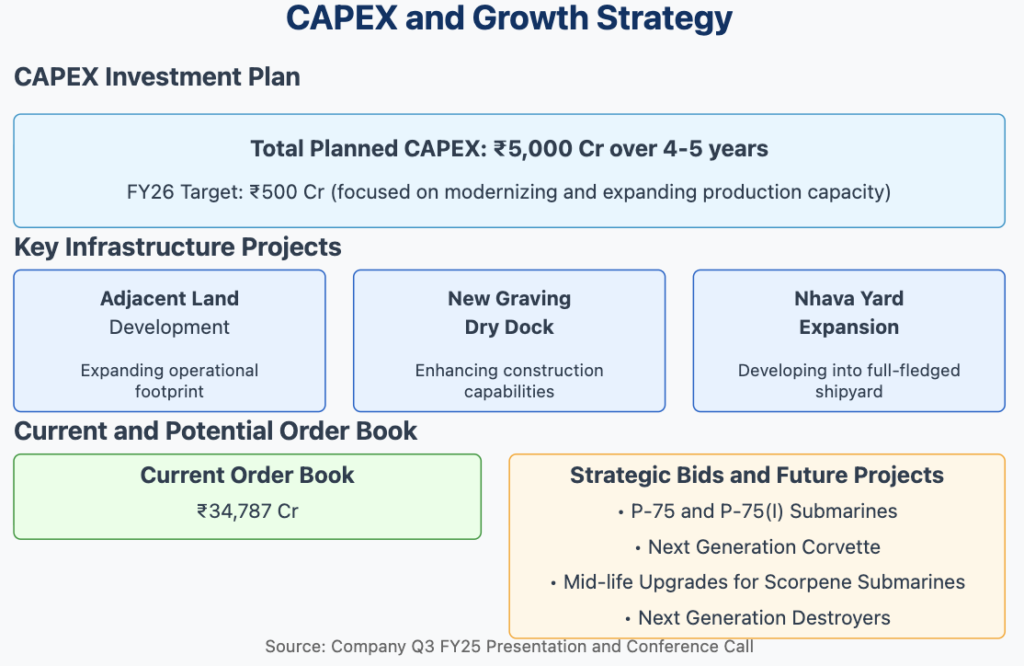

CAPEX & Growth Strategy

CAPEX & Infrastructure Upgrades

Mazagon Dock has outlined an ambitious capital expenditure program of approximately ₹5,000 Cr spread over the next 4-5 years. This significant investment is strategically directed toward:

- Development of adjacent land assets to expand operational footprint

- Construction of a new graving dry dock to enhance shipbuilding capabilities

- Expansion of the Nhava Yard into a full-fledged shipyard to increase capacity

Near-term CAPEX is projected at ₹500 Cr for FY26, with primary focus on modernizing and expanding production capacity to meet future order requirements.

Order Book & New Projects

The company maintains a robust order book valued at approximately ₹34,787 Cr, which includes all current projects. Management has indicated promising prospects for upcoming orders in critical segments including:

- P-75 and P-75(I) submarine programs

- Additional submarine orders

- Next-generation destroyers

- Next Generation Corvette program

- Mid-life upgrades for Scorpene submarines

The company is also exploring export potential, with preliminary exports such as support for Malaysian submarines suggesting broader international opportunities on the horizon.

Long-Term Financial Projections & Return Outlook

Long-Term Financial Projections

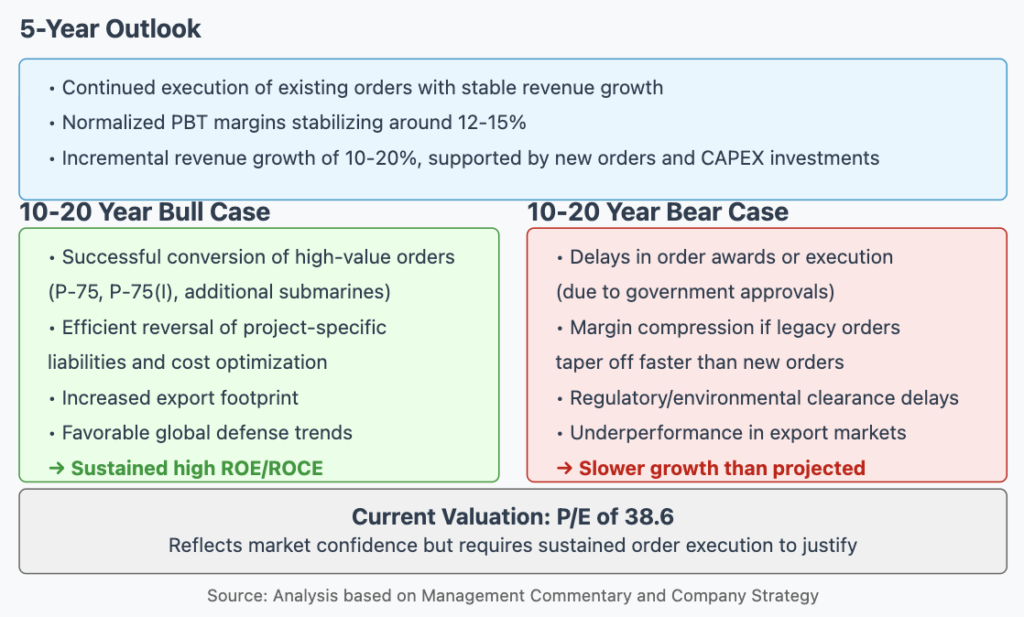

5-Year Outlook

Over the next five years, Mazagon Dock is expected to focus on:

- Continued execution of existing orders with stable revenue growth

- Normalized PBT margins stabilizing around the industry average of 12-15%

- Incremental revenue growth in the range of 10-20%, supported by new orders and ongoing CAPEX investments

10-20 Year Outlook

Bull Case Scenario

- Successful conversion of high-value orders including P-75, P-75(I), additional submarines, destroyers, and frigate programs

- Efficient reversal of project-specific liabilities and implementation of cost optimization measures

- Expanded export footprint and favorable global defense trends boosting revenues and margins

- Long-term returns benefiting from sustained high ROE/ROCE (currently at 44.2% and 35.2% respectively)

- Continuation of strong dividend distribution track record, albeit with a modest yield of 0.52%

Bear Case Scenario

- Delays in order awards or execution due to government approvals or technical challenges

- Margin compression if legacy high-margin orders taper off faster than new orders are secured

- Regulatory or environmental clearance delays impacting CAPEX projects and expansion plans

- Underperformance in export markets leading to slower growth than projected

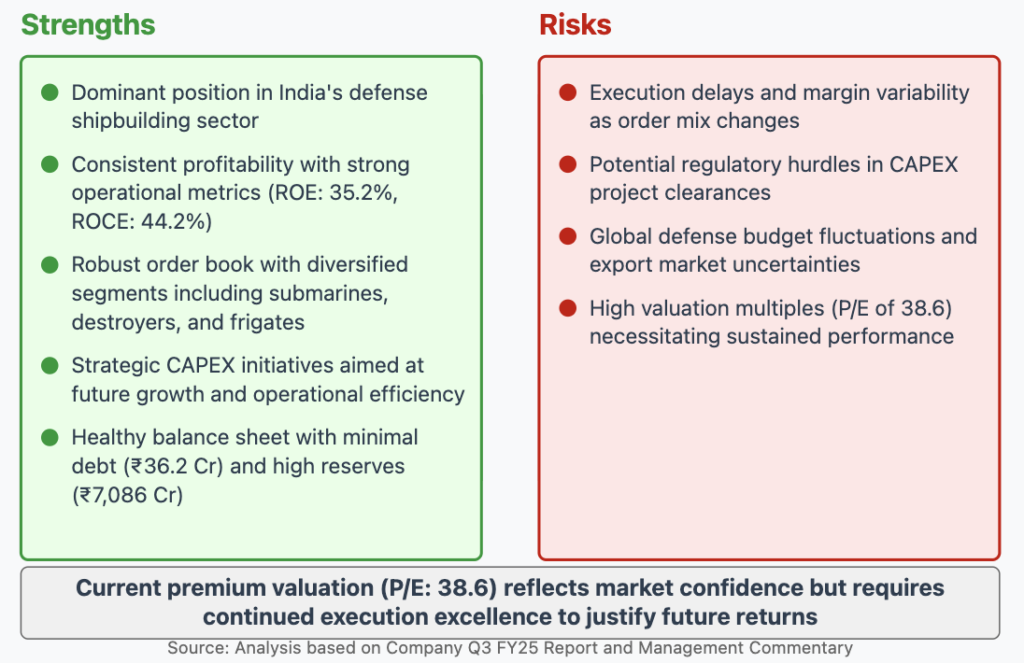

Valuation Perspective

The current premium valuation (P/E of 38.6) reflects market confidence in Mazagon Dock’s strategic positioning and operational efficiencies. However, this high valuation multiple requires sustained order execution and effective implementation of CAPEX plans to justify future returns for investors.

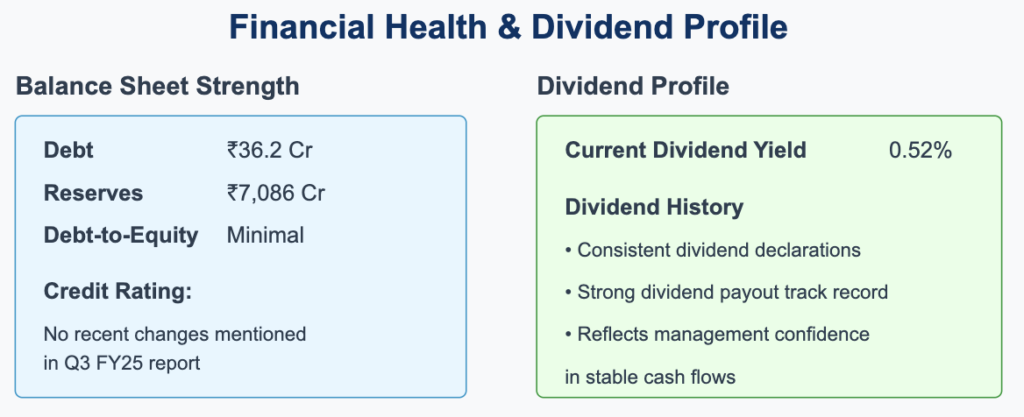

Credit Ratings & Financial Health

Financial Health & Dividend History

Credit Profile

While the Q3 FY25 report and investor presentation did not explicitly mention any recent changes in credit agency ratings, Mazagon Dock’s financial health remains exceptionally strong. The company’s balance sheet features:

- Minimal debt of just ₹36.2 Cr

- Substantial reserves of ₹7,086 Cr

- Very low debt-to-equity ratio

- Strong cash position

This robust financial position underscores the company’s creditworthiness and provides significant headroom for future capital expenditure plans without incurring excessive leverage.

Dividend Policy

Mazagon Dock Shipbuilders has maintained a consistent dividend distribution history with a current yield of 0.52%. The company’s strong dividend payout track record reflects management’s confidence in stable cash flows despite the modest current yield. This dividend policy is particularly notable given the substantial capital expenditure plans, indicating management’s balanced approach to shareholder returns while investing for future growth.

Investment Considerations

Investment Strengths and Risks

Strengths

- Dominant Market Position: Mazagon Dock maintains a leadership position in India’s defense shipbuilding sector, particularly in constructing submarines, destroyers, and frigates.

- Consistent Profitability: The company has demonstrated strong operational metrics with high ROE (35.2%) and ROCE (44.2%) figures, along with impressive 3-year sales and profit growth of approximately 33% and 47% respectively.

- Robust Order Book: The current order book of ₹34,787 Cr provides revenue visibility across diversified segments including submarines, destroyers, and frigates.

- Strategic CAPEX Initiatives: The planned ₹5,000 Cr CAPEX program over 4-5 years targets future growth and operational efficiency through infrastructure expansion and technology upgradation.

- Healthy Balance Sheet: The company maintains minimal debt (₹36.2 Cr) against substantial reserves (₹7,086 Cr), providing significant financial flexibility for future growth plans.

Risks

- Execution Delays: Potential delays in project execution and margin variability as the order mix changes from legacy high-margin orders to newer contracts.

- Regulatory Hurdles: Possible challenges in securing regulatory and environmental clearances for planned CAPEX projects.

- Defense Budget Fluctuations: Exposure to global defense budget dynamics and uncertainties in export markets could impact future order inflows.

- Premium Valuation: The current high P/E multiple of 38.6 requires sustained performance excellence to justify future returns for investors.

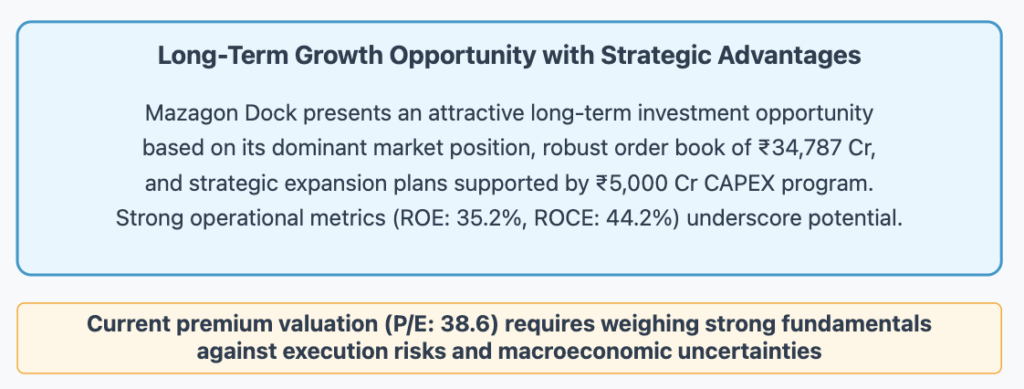

Conclusion

Investment Outlook Summary

Mazagon Dock Shipbuilders Limited presents an attractive long-term investment opportunity based on its dominant market position in India’s defense shipbuilding sector, robust order book of ₹34,787 Cr, and strategic expansion plans supported by a comprehensive ₹5,000 Cr CAPEX program spread over the next 4-5 years.

The company’s Q3 FY25 results demonstrate solid operational execution with strong financial metrics, including impressive ROE of 35.2% and ROCE of 44.2%. With minimal debt of just ₹36.2 Cr against substantial reserves of ₹7,086 Cr, the company maintains significant financial flexibility to fund its expansion plans while continuing its consistent dividend distribution policy.

While the current premium valuation (P/E of 38.6) reflects market confidence in the company’s long-term prospects, investors should carefully weigh the strong fundamentals and growth potential against execution risks, potential regulatory hurdles, and macroeconomic uncertainties before making investment decisions.

The company’s ability to secure and execute future high-value orders in submarine programs (P-75, P-75(I)), next-generation destroyers, and potential export opportunities will be crucial in determining whether it can maintain its strong growth trajectory over the 5-20 year horizon that would justify its current valuation multiples.

Disclaimer

This report is for informational purposes only and does not constitute investment advice. Investors should conduct their own research or consult a financial advisor before making any investment decisions.