Executive Summary

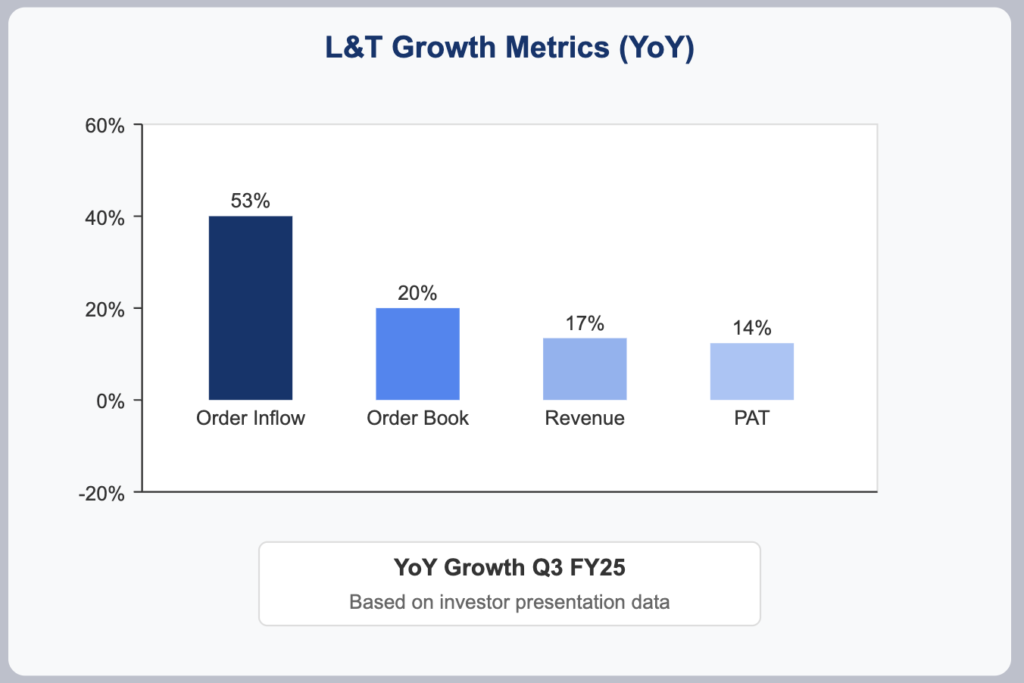

Larsen & Toubro Limited has posted exceptional results for Q3 FY25, achieving its highest-ever quarterly order inflow at ₹1,160 billion—representing a remarkable 53% year-on-year increase. The company’s order book has expanded by 20% to reach nearly ₹5.64 trillion, providing strong revenue visibility across its diversified business segments including Infrastructure, Energy Projects, and Hi-Tech Manufacturing. Despite challenging macroeconomic conditions, L&T has demonstrated solid execution capabilities while strategically positioning itself in high-growth sectors such as green energy, digital transformation, and semiconductor design.

Q3 FY25 Results: Breaking Records

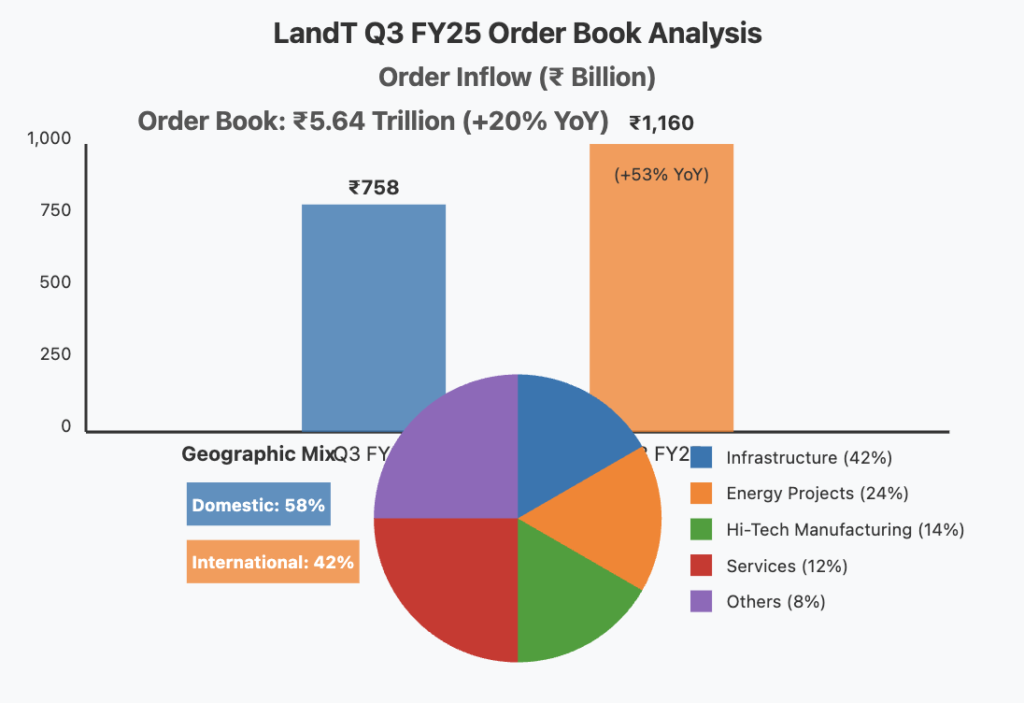

Order Inflows & Book

- Q3 order inflows: ₹1,160 billion (53% YoY increase)

- Order book: ₹5.64 trillion (20% YoY increase)

- Geographic mix: 58% domestic, 42% international

The substantial order growth was primarily driven by major contracts in Infrastructure, Hydrocarbon, CarbonLite Solutions, and Precision Engineering sectors, establishing a strong foundation for future revenue growth.

Revenue & Profitability

- Group revenues: ₹647 billion (17% YoY growth)

- Consolidated PAT: ₹33.6 billion (14% YoY growth)

- Projects & Manufacturing margins: Stable at 7.6%

Improved treasury operations and timely project billing contributed significantly to the profit growth, while margin variations reflected differing revenue mix and operating leverage across segments.

Segment Performance Analysis

Infrastructure

The Infrastructure segment maintained steady execution with balanced contribution from both domestic and international projects. The segment continues to be a cornerstone of L&T’s business portfolio, benefiting from increased infrastructure spending in India and Middle Eastern markets.

Energy Projects

This segment saw significant traction with ultra-super critical thermal power plant orders and a mega onshore hydrocarbon contract. While margins are still evolving as projects progress through various execution thresholds, the segment shows promising growth potential.

Hi-Tech Manufacturing

The segment maintained strong momentum with repeat orders, including the notable K9 Vajra repeat order, alongside several international deals that have strengthened the order book and diversified revenue streams.

Key Financial Metrics

- Market Cap: ₹4,69,753 Cr

- Current Price: ₹3,416

- P/E Ratio: 33.9

- Dividend Yield: 0.82%

- ROE: 14.7%

- ROCE: 13.4%

- Debt: ₹1,26,183 Cr

- Reserves: ₹88,955 Cr

Future Growth & Expansion Plans

Strategic Initiatives & Investments

Green Energy & Hydrogen

L&T Energy Green Tech has secured a significant 90,000 MTPA green hydrogen capacity order, which comes with incentives potentially totaling around ₹300 crores over three years. This positions L&T advantageously in the rapidly growing green energy sector.

Digital & IT Expansion

The company’s IT subsidiaries, LTIMindtree and LTTS, have recorded their highest-ever deal wins, including the strategic acquisition of Silicon Valley-based Intelliswift for USD 110 million. These moves strengthen L&T’s capabilities in software product development, data analytics, and artificial intelligence.

Capex Focus

L&T continues to invest substantially in forward-looking sectors such as green energy, data centers, and semiconductor design. These investments are expected to begin contributing meaningfully to earnings in the next strategic cycle (FY27–FY31).

Growth Strategy

The company’s diversified order pipeline, comprising significant domestic and international opportunities, supports expectations for near-term revenue growth and margin improvement. Ongoing large contracts, particularly in the Projects & Manufacturing portfolio, are anticipated to drive sustained top-line expansion.

L&T is also exploring new avenues in semiconductor design and digital transformation, with potential entry into additional value chains if initial ventures prove successful.

Expense Analysis & CAPEX Insights

Expense Trends

- Manufacturing & Construction Costs: Increased due to higher activity levels and projects with longer execution timelines

- Staff Costs: Rising in line with workforce expansion and regular salary increases

- SG&A and Depreciation: Reflect ongoing execution ramp-up and recent capital investments

CAPEX & Growth Strategy

L&T is reinvesting a significant portion of its free cash flow to expand capacity in emerging sectors like green energy, digital infrastructure, and semiconductor design. This strategic allocation of capital aims to enhance earnings potential and competitive positioning over the FY27-FY31 cycle.

Bull Case vs. Bear Case

Bull Case

- Continued robust order inflows driven by infrastructure spending in India and the Middle East

- Successful execution of the existing ₹5.64 trillion order book leading to strong revenue growth

- Strategic investments in green energy and digital transformation yielding higher margins

- Expansion into high-growth sectors creating new revenue streams

- Margin improvement through better project execution and operating leverage

Bear Case

- Project delays or cost overruns affecting margins

- High P/E ratio of 33.9 suggesting elevated market expectations

- Potential challenges in international markets due to geopolitical uncertainties

- Competition intensifying in core segments

- Working capital challenges if project execution or payment cycles lengthen

Long-Term Projections

5-Year Outlook

- Revenue projected to grow at or above current guidance (15%+ annual growth)

- Margin stabilization expected as execution of mega projects progresses

- Efficiency gains anticipated from improved working capital management and reduced financing costs

10- to 20-Year Outlook

L&T’s strategic diversification into high-growth areas positions the company for long-term success. While precise numerical projections depend on macroeconomic variables, qualitative expectations include:

- Sustained top-line expansion driven by infrastructure development in core markets

- Incremental improvements in profitability as project execution enhances and digital/technology investments mature

- Long-term total returns potentially attractive relative to current valuation

Valuation & Credit Rating Considerations

Valuation Metrics

With a P/E of 33.9 and a book value of ₹649, L&T is positioned as a growth-oriented investment. The current valuation reflects high market expectations for future performance.

Dividend History and Yield

The company maintains a moderate dividend yield of 0.82%, typical for a capital-intensive conglomerate prioritizing reinvestment in growth opportunities.

Credit Perspective

No significant changes in credit agency ratings were reported during Q3 FY25. The company’s stable working capital improvements and balanced debt-reserve profile support a resilient credit outlook.

Conclusion

Larsen & Toubro’s Q3 FY25 performance demonstrates the company’s strong execution capabilities and strategic vision. The record-breaking order inflow, robust order book, and diversified revenue segments offer a compelling near-term outlook, while strategic investments in future-focused sectors establish the foundation for long-term growth.

Investors should note the elevated valuation multiples and moderate dividend yield, which reflect market expectations for sustained growth. As L&T continues to execute its strategic plan and capitalize on emerging opportunities, it remains well-positioned to deliver value to shareholders over the long term.

Disclaimer: This article is not investment advice and should not be taken as a recommendation to buy or sell securities. Investors should conduct their own due diligence and consider their financial objectives before making any investment decisions.