Waaree Renewable Technologies Ltd (NSE: WAAREERTL), a leading player in India’s renewable energy landscape, has posted impressive financial Latest Q4 FY2025 Results, demonstrating robust growth and positioning itself strategically in the expanding solar energy sector. This comprehensive analysis examines the company’s recent performance metrics, strategic initiatives, and long-term growth trajectory.

Executive Overview

Waaree RTL, a subsidiary of Waaree Energies, has cemented its position as India’s premier solar EPC player with vertically integrated capabilities across the value chain. The company’s Q4 FY25 performance highlights include:

- 74.4% year-over-year revenue growth to ₹476.6 crore

- 75.4% increase in consolidated PAT to ₹93.8 crore

- Impressive EPS of ₹9.00, up 75.1% from previous year

- EBITDA margin of 19.5%, showing slight compression of 130 basis points

- Robust order book of 3,263 MWp, representing 38% year-over-year growth

Waaree RTL Q4 FY25 Performance Metrics

Key Financial Metrics & Position

Market Position:

- Market Capitalization: ₹10,700 crore

- Current Price: ₹1,026 per share

- 52-week Range: ₹732-₹3,038

Valuation Metrics:

- P/E Ratio (FY25): 46.0×

- P/BV Ratio: 23.4× (Book Value ₹43.8)

- ROE: 65.3%

- ROCE: 61.9%

Financial Strength:

- Net Debt: ₹27.4 crore

- Annual Sales (FY25): ₹1,597.8 crore (+84.2% 3-year CAGR)

- Net Worth: ₹454.9 crore

- Cash Position: ₹78.8 crore

- Dividend: ₹1 per share (Yield: 0.10%)

Management & Governance Updates

Waaree RTL has strengthened its leadership team with strategic appointments effective April 16, 2025:

- Mr. Sudhir Arya appointed as Independent Director

- Mr. Sunil Rathi elevated to Executive Director

- Mr. Manmohan Sharma appointed as CFO

The company’s ESOP plan recorded a charge of ₹29.1 lacs for the year, with a cumulative 6.87 lacs options issued. CARE Ratings has affirmed an A+ (Stable) rating, reflecting strong financial health and enabling competitive project financing capabilities.

Growth Strategy & CAPEX Plans

Waaree RTL Growth Strategy & Expansion Plans

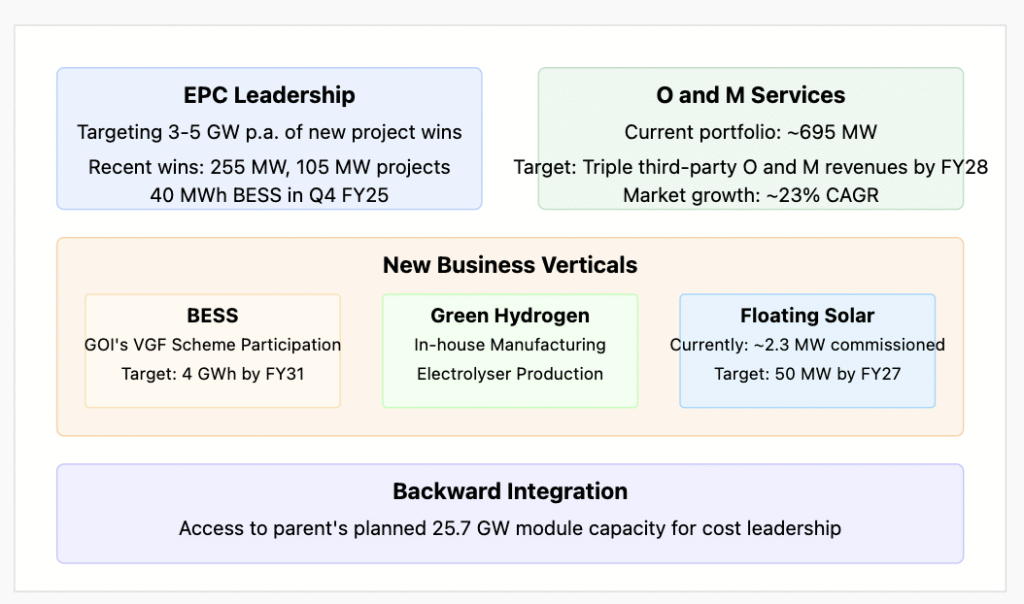

Waaree RTL has outlined an ambitious growth strategy focusing on four key areas:

- EPC Leadership:

- Targeting 3-5 GW per annum of new project wins

- Recent successes include 255 MW and 105 MW solar projects

- Secured 40 MWh BESS (Battery Energy Storage System) project in Q4

- O&M Services:

- Currently managing ~695 MW O&M portfolio

- Aim to triple third-party O&M revenues by FY28

- Leveraging market growth projected at ~23% CAGR

- New Business Verticals:

- BESS: Participation in Government of India’s VGF scheme with plans to develop 4 GWh by FY31

- Green Hydrogen: In-house manufacturing of electrolysers

- Floating Solar: 2.3 MW already commissioned with target expansion to 50 MW by FY27

- Backward Integration:

- Strategic access to parent company’s planned 25.7 GW module manufacturing capacity

- Ensures cost leadership and supply chain security

Long-Term Projections & Returns Analysis

Waaree RTL 20-Year Financial Projections

Waaree RTL has presented comprehensive long-term financial projections spanning the next 20 years, showcasing significant growth potential:

5-Year Outlook (FY30):

- Revenue: ₹3,974 crore (20% CAGR from FY25)

- PAT: ₹557 crore

- EPS: ₹53.4

- ROE: 35%

- Implied Price (@25× PE): ₹1,335 (+30% from current)

10-Year Outlook (FY35):

- Revenue: ₹8,000 crore (15% CAGR from FY30)

- PAT: ₹1,120 crore

- EPS: ₹107.2

- ROE: 30%

- Implied Price: ₹2,680 (+161% from current)

15-Year Outlook (FY40):

- Revenue: ₹15,616 crore (12% CAGR from FY35)

- PAT: ₹2,186 crore

- EPS: ₹209.4

- ROE: 25%

- Implied Price: ₹5,235 (+410% from current)

20-Year Outlook (FY45):

- Revenue: ₹25,360 crore (10% CAGR from FY40)

- PAT: ₹3,631 crore

- EPS: ₹347.6

- ROE: 20%

- Implied Price: ₹8,690 (+748% from current)

Total Return Potential:

- 5-year CAGR: 4.2%

- 10-year CAGR: 8.7%

- 15-year CAGR: 11.5%

- 20-year CAGR: 12.8%

These projections assume a gradual deceleration in revenue growth rates over time, stable margin and payout ratios, and P/E multiple re-rating to a long-term average of 25× as the company matures.

Expense Analysis & Growth Metrics

Waaree RTL Expense Analysis & Growth Metrics

Waaree RTL has delivered impressive growth metrics while managing its expenses effectively:

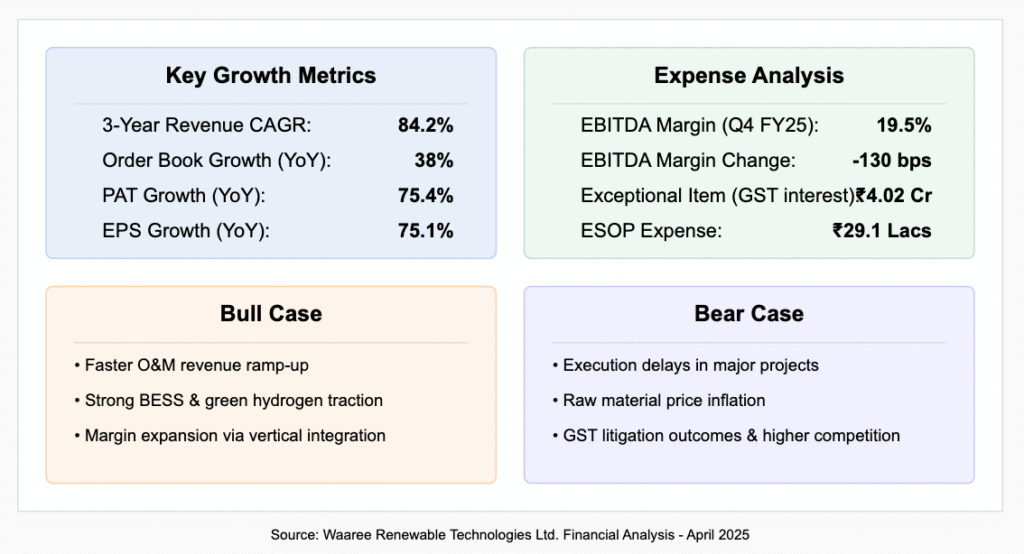

Growth Metrics:

- 3-Year Revenue CAGR: 84.2%

- Order Book Growth (YoY): 38%

- PAT Growth (YoY): 75.4%

- EPS Growth (YoY): 75.1%

Expense Analysis:

- EBITDA Margin (Q4 FY25): 19.5%

- EBITDA Margin Change: -130 basis points

- Exceptional Item (GST interest): ₹4.02 crore charge

- ESOP Expense: ₹29.1 lacs

Bull Case Scenario:

- Faster O&M revenue ramp-up than projected

- Strong traction in BESS and green hydrogen segments

- Margin expansion through vertical integration efficiencies

- Higher multiple re-rating with accelerated clean energy adoption

Bear Case Scenario:

- Execution delays in major projects

- Raw material price inflation impacting margins

- Unfavorable GST litigation outcomes

- Increased competition in the solar EPC space

- Interest rate hikes affecting project economics

Credit Rating & Dividend Analysis

Waaree RTL Credit Rating & Dividend Analysis

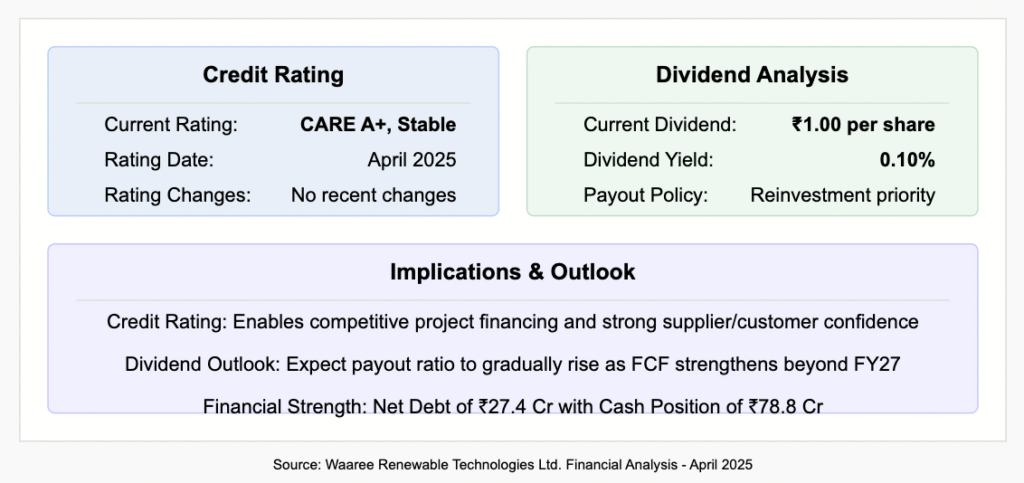

Credit Rating Analysis:

- Current Rating: CARE A+, Stable (April 2025)

- No recent changes in rating

- Implications: Strong credit rating enables competitive project financing and bolsters customer/supplier confidence

- Financial Strength: Net debt of ₹27.4 crore with cash reserves of ₹78.8 crore

Dividend Policy & Yield:

- Current Dividend: ₹1.00 per share

- Dividend Yield: 0.10%

- Payout Policy: Reinvestment priority for growth

- Future Outlook: Payout ratio expected to gradually increase as free cash flow strengthens beyond FY27

Valuation Analysis

Waaree RTL Valuation Analysis

At its current price of ₹1,026 per share, Waaree RTL trades at premium valuations compared to industry peers, though with significant justifications:

Current Valuation Metrics:

- Market Capitalization: ₹10,700 crore

- Price: ₹1,026 per share

- 52-week Range: ₹732-₹3,038

- P/E Ratio (FY25): 46.0×

- P/BV Ratio: 23.4× (Book Value: ₹43.8)

Peer Comparison:

- Waaree RTL: P/E 46.0×, ROE 65.3%, 3-Year Revenue CAGR 84.2%

- Mid-cap Peer Average: P/E 20×-25×, ROE 25-30%, 3-Year Revenue CAGR 40-45%

Fair Value Assessment:

- Fair Value Range: ₹1,250-₹1,300 (25× FY30E EPS)

- Premium Valuation Justification:

- Industry-leading ROE exceeding 60%

- Asset-light business model with strong capital efficiency

- Exceptional growth visibility through robust order book

- Strategic diversification into BESS and green hydrogen

- Vertical integration advantages through parent company

Conclusion & Investment Outlook

Waaree Renewable Technologies has demonstrated exceptional financial performance in Q4 FY25, with revenue growth of 74.4% and PAT growth of 75.4% year-over-year. The company’s strong order book of 3,263 MWp provides visibility for continued growth, while strategic initiatives in BESS, green hydrogen, and floating solar position it well for the future.

With India’s solar capacity addition projected to grow at a 23% CAGR over FY25-30, Waaree RTL is well-positioned to capitalize on this tremendous market opportunity. The company’s vertical integration advantages, industry-leading ROE of 65.3%, and robust balance sheet provide a strong foundation for sustained growth.

While the current valuation at 46× FY25 EPS appears premium compared to peers, it is justified by the company’s superior growth metrics and return ratios. The long-term return potential remains attractive, with projected 20-year CAGR of 12.8%, translating to potential returns of 748% by FY45.

For investors seeking exposure to India’s renewable energy transition, Waaree RTL presents a compelling investment case with its leadership position, technological capabilities, and strong execution track record. The fair value range of ₹1,250-₹1,300 suggests upside potential from current levels, making it an attractive consideration for both growth and value investors with a long-term horizon.

Key Investment Considerations:

- Strong execution capability demonstrated by 74.4% revenue growth

- Industry-leading ROE of 65.3% with asset-light model

- Robust order book providing multi-year growth visibility

- Strategic diversification into high-growth segments

- Fair value upside of approximately 22-27% from current levels

Disclaimer: This report is for informational purposes only and does not constitute investment advice. Investors should conduct their own due diligence and/or consult a registered financial advisor before making investment decisions.