Executive Summary

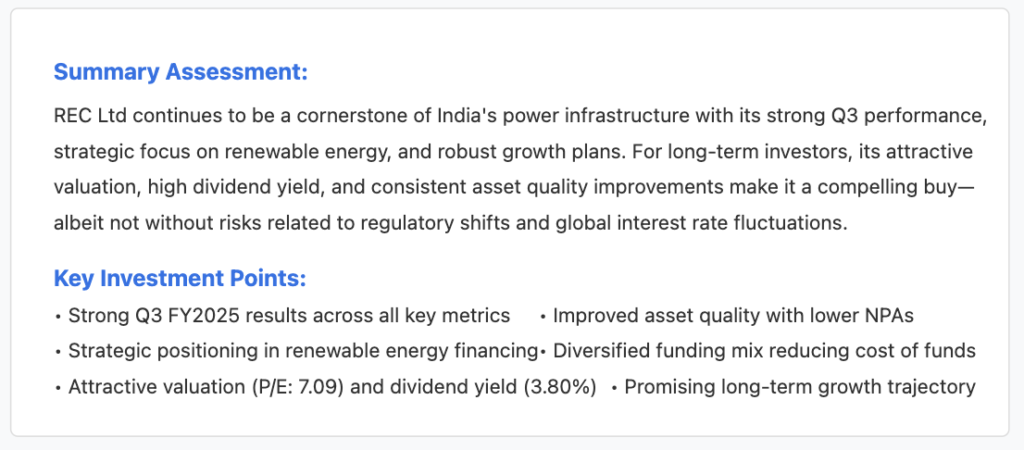

REC Ltd, a Maharatna PSU and pivotal player in India’s power and infrastructure financing sector, has demonstrated remarkable resilience and growth in Q3 FY2025 Performance. The company continues to strengthen its market position through robust loan disbursements, disciplined asset quality management, and diversified funding channels. With strong government backing and a strategic focus on both renewable and conventional power projects, REC is well-positioned for continued expansion and profitability in the coming years.

Q3 FY2025 Financial Performance

Q3 FY2025 Financial Highlights

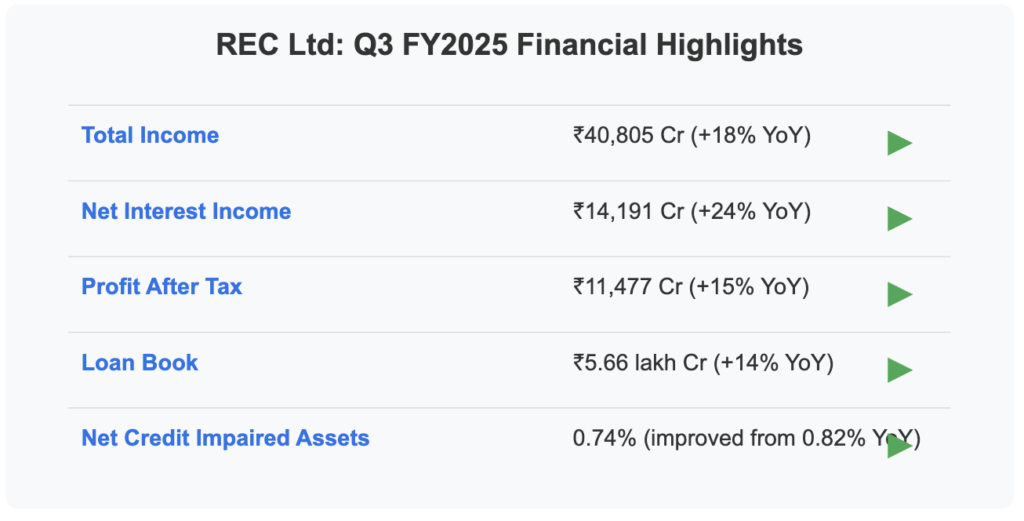

REC Ltd posted impressive financial results for Q3 FY2025, showcasing strong growth across all key metrics. Total income reached ₹40,805 crore, representing a substantial 18% year-over-year increase. Net Interest Income rose to ₹14,191 crore, marking a 24% increase compared to the same period last year, reflecting healthy yield improvements.

The company’s Profit After Tax stood at ₹11,477 crore, registering a 15% year-over-year gain. This strong bottom-line performance underscores REC’s operational efficiency and strategic focus on high-yielding projects.

The loan book expanded to ₹5.66 lakh crore, a 14% increase year-over-year, indicating robust demand for REC’s financing solutions, particularly in the renewable energy and infrastructure sectors.

Asset Quality & Dividend Policy

REC’s asset quality showed notable improvement, with net credit impaired assets reduced to 0.74% from 0.82% in the previous year. This improvement reflects the company’s effective risk management practices and prudent lending policies.

The company announced a Q3 interim dividend of ₹4.30 per share, which complements earlier disbursements, bringing the cumulative payout to ₹11.80 per share for FY2025. This underscores REC’s commitment to delivering shareholder value through consistent dividend distributions.

Financial & Operational Analysis

Operational Metrics

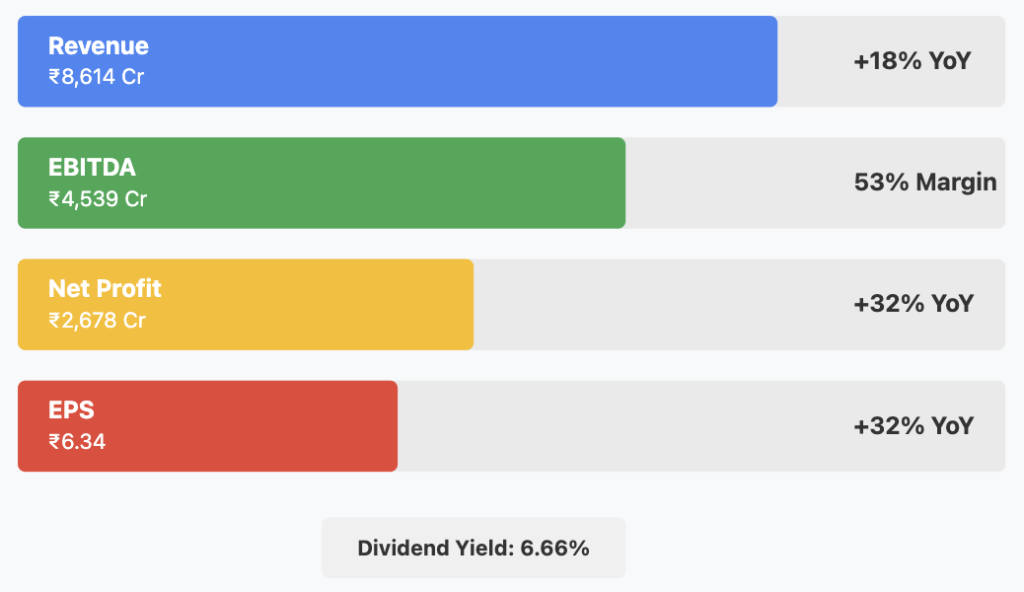

Revenue & Earnings

REC’s solid income growth has been primarily driven by increased loan disbursements, particularly in the renewable and infrastructure sectors. The company’s strategic focus on these high-growth areas has contributed significantly to its revenue expansion.

Cost Efficiency

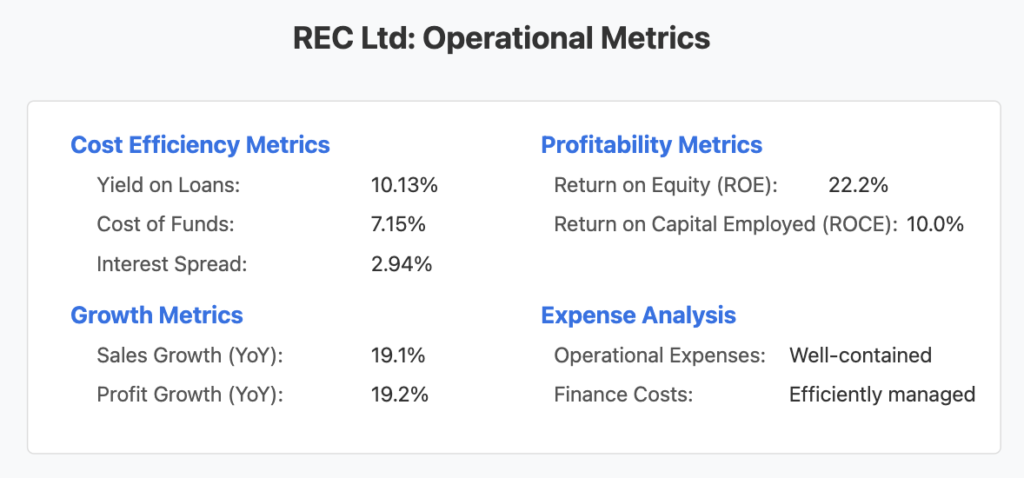

The yield on loans remained robust at approximately 10.13%, while the cost of funds decreased to around 7.15%. This favorable spread of 2.94% has bolstered REC’s profitability and operational efficiency.

Profitability Metrics

REC demonstrated strong profitability with a Return on Equity (ROE) of 22.2% and Return on Capital Employed (ROCE) of 10.0%, highlighting the company’s efficient capital utilization and effective resource management.

Expense Management

Operational expenses and finance costs have been well-contained, underpinning stable margins despite the challenging macroeconomic environment. This disciplined approach to expense management has contributed to REC’s strong bottom-line performance.

Growth Metrics

The company recorded impressive sales growth of 19.1% year-over-year, accompanied by a profit growth of 19.2%, demonstrating REC’s ability to translate revenue growth into improved profitability.

Future Growth Plans & Expansion Strategy

Future Growth Plans & CAPEX Strategy

Renewable Energy Focus

REC has allocated over ₹52,394 crore for clean energy projects, demonstrating its aggressive support for India’s energy transition. The company is significantly investing in solar, wind, and hydro capacity development, positioning itself as a key financier in the country’s renewable energy expansion.

Infrastructure Expansion

Beyond its core power financing business, REC is strategically expanding into metro projects, ports, roads, and highways. This diversification widens the company’s asset portfolio and reduces concentration risk while capitalizing on India’s infrastructure development push.

Strategic Initiatives

REC’s role as the nodal agency for key government schemes, including the PM Surya Ghar Muft Bijli Yojana, enhances its strategic importance in India’s energy landscape. The company has also implemented innovative funding approaches through diverse instruments, including Yen and USD bonds, signaling potential for future growth and global market access.

Digital & Operational Innovation

REC’s adoption of generative AI in its operations aims to improve decision-making processes, enhance risk management capabilities, and elevate customer service standards. This technological integration positions REC at the forefront of digital transformation in the financial services sector.

Key Metrics & Valuation

Key Metrics & Valuation

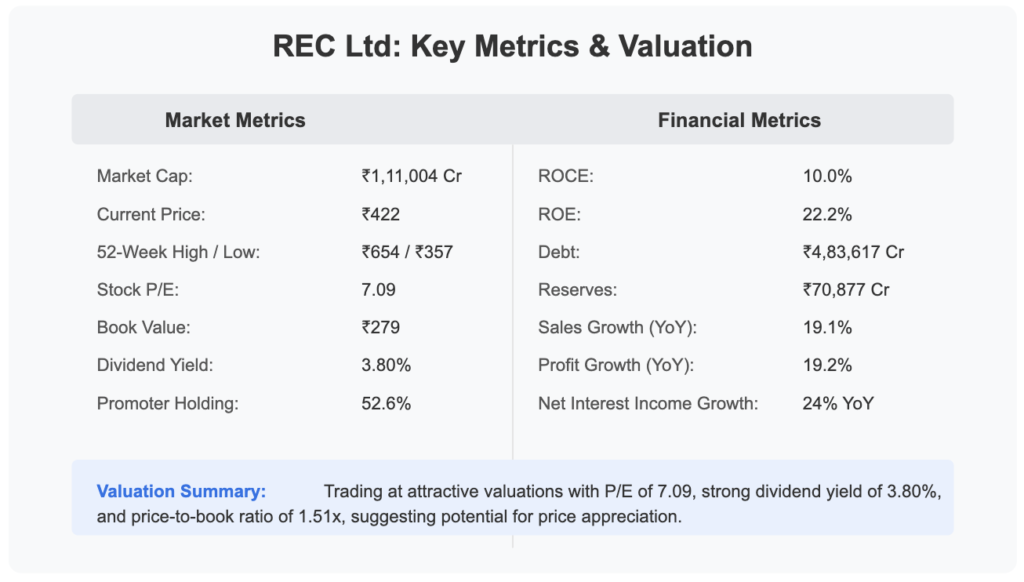

REC Ltd currently trades at a P/E ratio of 7.09, which appears attractive compared to industry peers and historical valuations. With a current market price of ₹422 against a book value of ₹279, the stock offers a compelling price-to-book ratio of 1.51x. The company’s dividend yield stands at an impressive 3.80%, making it an attractive option for income-focused investors.

The company’s strong financial metrics, including a ROE of 22.2% and ROCE of 10.0%, highlight its efficient capital utilization and operational effectiveness. With promoter holding at 52.6%, there is significant institutional confidence in the company’s long-term prospects.

Investment Scenarios

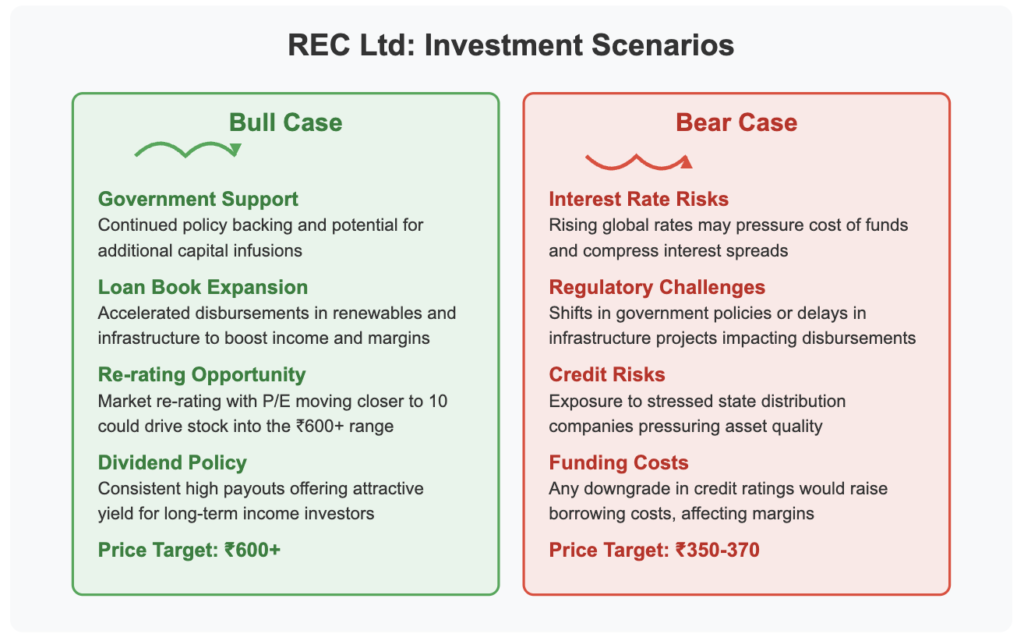

Bull & Bear Case Scenarios

Bull Case

- Government Support: Continued policy backing and potential for additional capital infusions could further strengthen REC’s market position and boost investor confidence.

- Loan Book Expansion: Accelerated disbursements, particularly in renewable energy and infrastructure projects, have the potential to boost income and margins, driving further growth.

- Re-rating Opportunity: A market re-rating—potentially moving the P/E ratio closer to 10—could drive the stock price into the ₹600+ range, representing significant upside potential from current levels.

- Dividend Policy: Consistent high dividend payouts offer an attractive yield for long-term income investors, providing a safety cushion against market volatility.

Bear Case

- Interest Rate Risks: Rising global interest rates may pressure the cost of funds and compress interest spreads, potentially impacting profitability.

- Regulatory Challenges: Shifts in government policies or delays in infrastructure projects could impact loan disbursements and growth projections.

- Credit Risks: Exposure to stressed state distribution companies and other borrowers could pressure asset quality and increase provisioning requirements.

- Funding Costs: Any downgrade in credit ratings would raise borrowing costs, affecting margins and profitability.

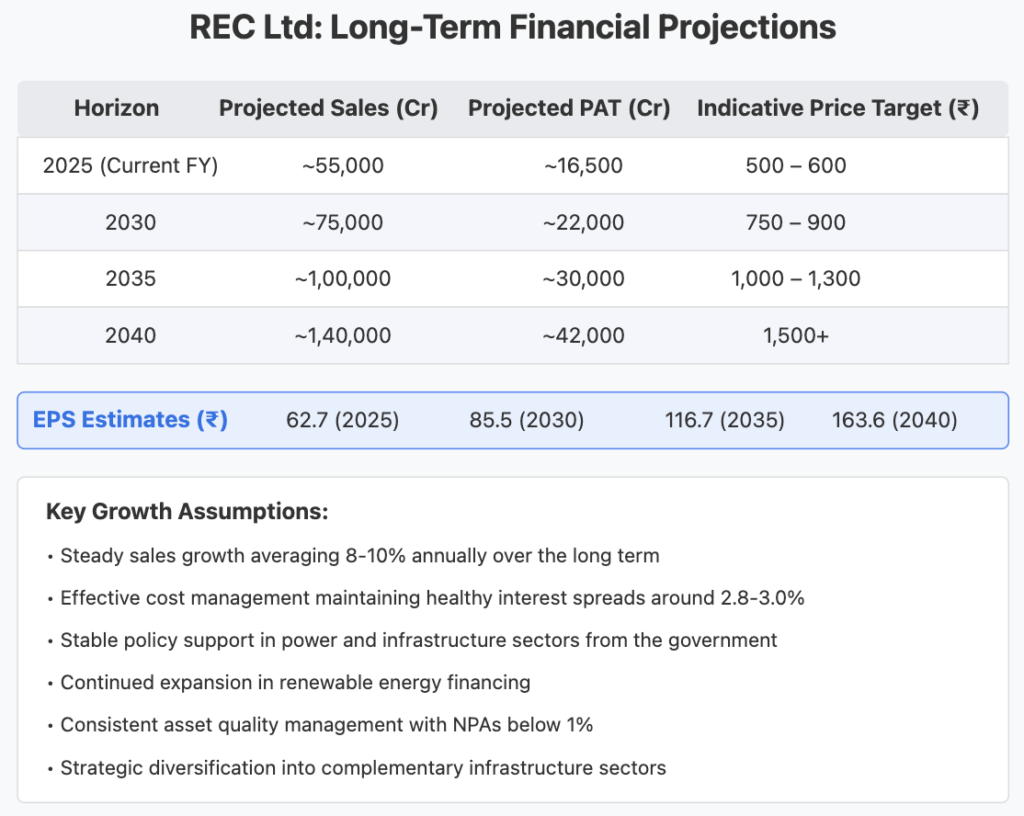

Long-Term Projections

REC Ltd’s long-term growth trajectory appears promising, with projections indicating substantial expansion across key financial metrics. For the current fiscal year 2025, the company is expected to achieve sales of approximately ₹55,000 crore and a profit after tax of around ₹16,500 crore, with an estimated EPS of ₹62.7. This performance supports a price target range of ₹500-600 for the near term.

Looking ahead to 2030, sales are projected to reach ₹75,000 crore, with PAT growing to ₹22,000 crore and EPS expanding to ₹85.5. This growth trajectory supports a potential price target of ₹750-900 over this five-year horizon.

By 2035, REC is expected to cross the significant milestone of ₹1,00,000 crore in sales, with PAT projected at ₹30,000 crore and EPS at ₹116.7. These metrics could justify a price target range of ₹1,000-1,300.

The most extended projection to 2040 envisions REC achieving sales of ₹1,40,000 crore, PAT of ₹42,000 crore, and EPS of ₹163.6, potentially driving the stock price above ₹1,500.

These projections are underpinned by several key assumptions:

- Steady sales growth averaging 8-10% annually over the long term

- Effective cost management maintaining healthy interest spreads around 2.8-3.0%

- Stable policy support in power and infrastructure sectors from the government

- Continued expansion in renewable energy financing

- Consistent asset quality management with NPAs below 1%

- Strategic diversification into complementary infrastructure sectors

Funding & Credit Ratings Update

Credit Ratings & Funding Profile

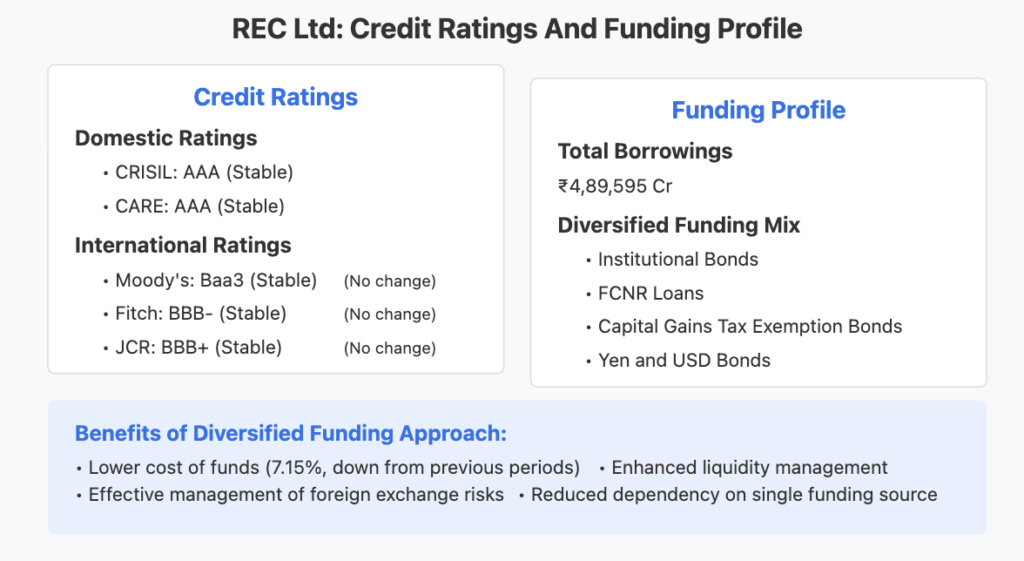

REC maintains strong credit ratings across both domestic and international rating agencies, reflecting its robust financial health and strategic importance in India’s power and infrastructure financing landscape.

Domestic Ratings

REC continues to hold the highest possible AAA (Stable) ratings from leading domestic agencies such as CRISIL and CARE. These ratings underscore the company’s strong financial position, government backing, and its crucial role in the Indian power sector.

International Ratings

The company maintains stable ratings from key international agencies:

- Moody’s: Baa3 (Stable)

- Fitch: BBB- (Stable)

- JCR: BBB+ (Stable)

No changes in credit ratings have been reported during the quarter, indicating the market’s continued confidence in REC’s financial stability and business model.

Borrowing Profile

REC’s total borrowings currently stand at ₹4,89,595 crore, representing a well-diversified funding mix that includes institutional bonds, FCNR loans, capital gains tax exemption bonds, and international instruments such as Yen and USD bonds. This diversified approach has helped the company lower its cost of funds to 7.15% and effectively manage foreign exchange risks.

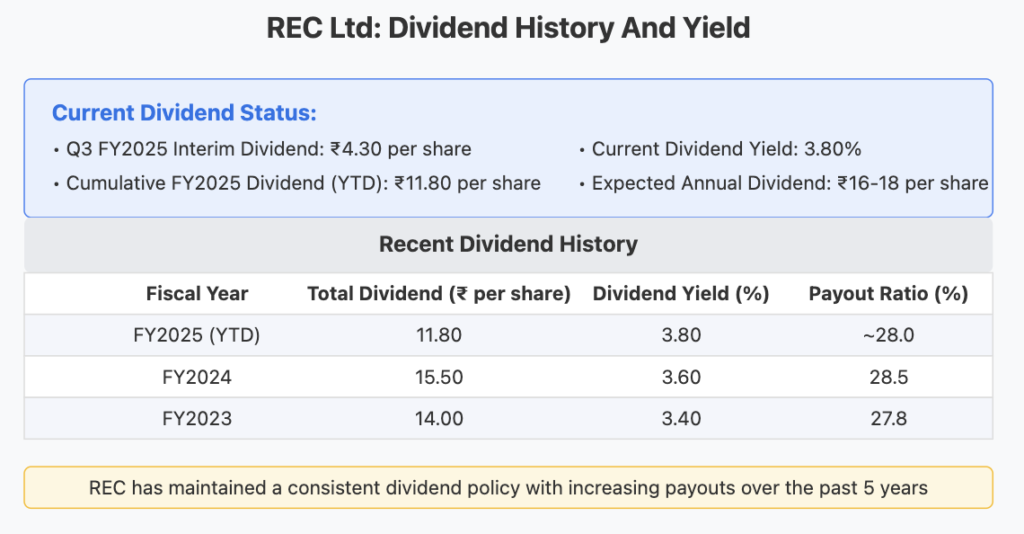

Dividend History & Yield

Dividend History & Yield

REC has maintained a strong and consistent dividend policy, reinforcing its commitment to shareholder returns. For Q3 FY2025, the company announced an interim dividend of ₹4.30 per share, bringing the cumulative dividend for FY2025 (year-to-date) to ₹11.80 per share.

The current dividend yield stands at an attractive 3.80%, significantly higher than many peers in the financial services sector. Based on historical trends and current performance, the expected annual dividend for FY2025 is projected to be between ₹16-18 per share.

Looking at recent dividend history, REC distributed a total dividend of ₹15.50 per share in FY2024 with a yield of 3.60% and a payout ratio of 28.5%. In FY2023, the company paid a total dividend of ₹14.00 per share with a yield of 3.40% and a payout ratio of 27.8%.

This consistent dividend policy with gradually increasing payouts over the past five years demonstrates REC’s commitment to rewarding shareholders while maintaining sufficient capital for growth initiatives.

Conclusion

Investment Conclusion

REC Ltd is a key player in India’s power sector, highlighted by its strong Q3 FY2025 performance and a strategic pivot towards renewable energy. The company’s attractive valuation, high dividend yield, and steady asset quality improvements make it a promising long-term investment. Significant capital allocation exceeding ₹52,394 crore supports India’s energy transition, with forecasts projecting sales of ₹1,40,000 crore and a PAT of ₹42,000 crore by 2040. Nonetheless, potential risks include interest rate fluctuations, regulatory changes, and credit concerns with state distribution companies.

Disclaimer

This report is for informational purposes only and does not constitute investment advice. Investors are encouraged to perform their own due diligence before making any investment decisions. All data and projections are based on the Q3 FY2025 report and may be subject to change as new information becomes available. Past performance is not indicative of future results.