The Foundation of Investment Analysis

Understanding Financial Statements like income statement, often called the profit and loss statement, serves as a financial narrative of a company’s operational performance over a specific period. While balance sheets capture a moment in time, income statements tell the story of a company’s ability to generate revenue and manage expenses—essential factors for long-term wealth creation. This financial document reveals not just profitability but also operational efficiency, management effectiveness, and competitive positioning within an industry.

Decoding the Income Statement Structure

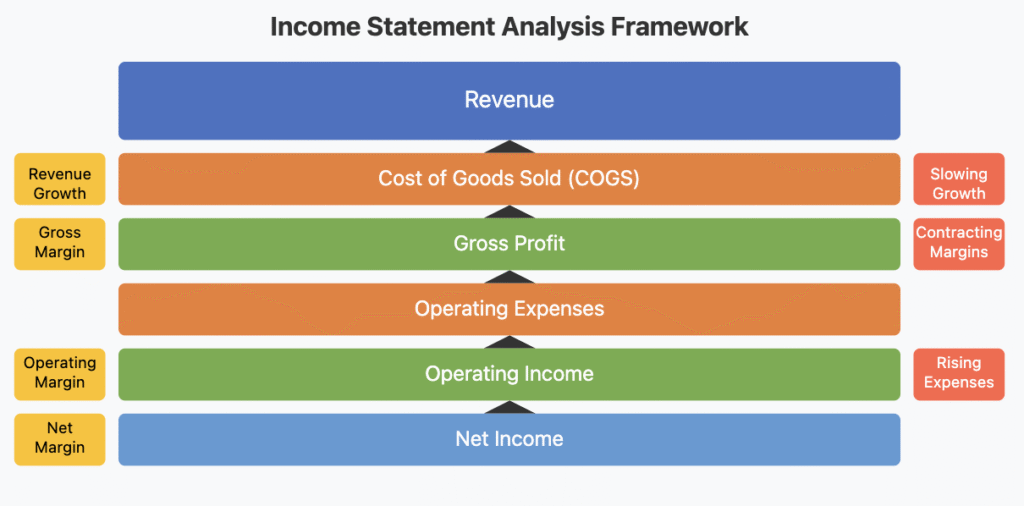

An income statement follows a logical progression from revenue to net income, creating a comprehensive picture of how efficiently a company converts sales into profit. Understanding each component allows investors to identify both strengths and potential warning signs.

Revenue Section

The statement begins with revenue (or sales)—the total income generated from providing products or services. Companies often break this down into operating revenue (core business activities) and non-operating revenue (investments, asset sales, etc.). For example, Apple (AAPL) reports both product revenue and services revenue, allowing investors to track the growing importance of their digital ecosystem alongside hardware sales.

Cost of Goods Sold (COGS)

Following revenue, COGS represents direct expenses associated with producing goods or services sold. This includes raw materials, direct labor, and manufacturing overhead. The difference between revenue and COGS produces the gross profit, with the gross margin percentage serving as a vital indicator of pricing power and production efficiency.

Operating Expenses

These expenses support the business but aren’t directly tied to production—sales and marketing, research and development, general and administrative costs. Microsoft (MSFT), for instance, maintains significant R&D expenses that, while reducing short-term profitability, fuel long-term innovation and market leadership.

Operating Income

Operating income (or operating profit) measures profitability from core business operations, excluding interest and taxes. This figure is crucial for evaluating management’s effectiveness at generating profit from regular business activities.

Other Income and Expenses

This section covers non-operational items like interest income, interest expense, and one-time gains or losses. Long-term investors should carefully scrutinize one-time items to understand whether they distort the company’s true operating performance.

Net Income

The bottom line—what remains after all expenses, taxes, and other costs—represents the profit available to shareholders, either as dividends or retained for business growth.

Practical Application for Investors

Analyzing income statements effectively requires both horizontal analysis (comparing changes over time) and vertical analysis (expressing components as percentages of revenue). Follow these steps to extract meaningful insights:

- Track revenue growth rates over several quarters and years, looking for consistent expansion.

- Monitor margin trends (gross, operating, and net margins) for signs of improving or deteriorating business fundamentals.

- Compare these metrics against industry peers to identify competitive advantages or weaknesses.

- Investigate any significant year-over-year changes in specific expense categories, which may signal shifts in business strategy or efficiency.

- Calculate and track key ratios like the efficiency ratio (operating expenses/revenue) to gauge operational excellence.

Income Statement Analysis Framework

Real-World Application

Consider Nestlé (NESN.SW), a consumer staples company with consistent revenue growth and stable margins—hallmarks of resilience during economic downturns. Their income statement reveals how premium pricing and operational efficiency combine to maintain profitability despite commodity price fluctuations. During the 2020 pandemic, while many companies faltered, Nestlé’s income statement showed remarkable stability—a testament to the defensive characteristics that make consumer staples valuable portfolio components during market uncertainty.

In contrast, examine Tesla (TSLA), which demonstrated explosive revenue growth but operated with negative or thin margins for years. Long-term investors who correctly interpreted these income statements recognized that Tesla was prioritizing scale and market dominance over immediate profitability—a strategy that eventually led to significant margin improvement as production volumes increased.

Learning Impact

The income statement offers a window into a company’s operational effectiveness and future potential. By mastering its analysis, you gain the ability to separate truly excellent businesses from mediocre ones—a critical skill for building generational wealth. Rather than being intimidated by financial statements, use the income statement as your guide to identifying companies with sustainable competitive advantages reflected in superior revenue growth and margin expansion. These financial fingerprints often signal businesses capable of compounding shareholder value for decades, the very foundation of lasting investment success.

Leave a Reply

You must be logged in to post a comment.