Executive Summary

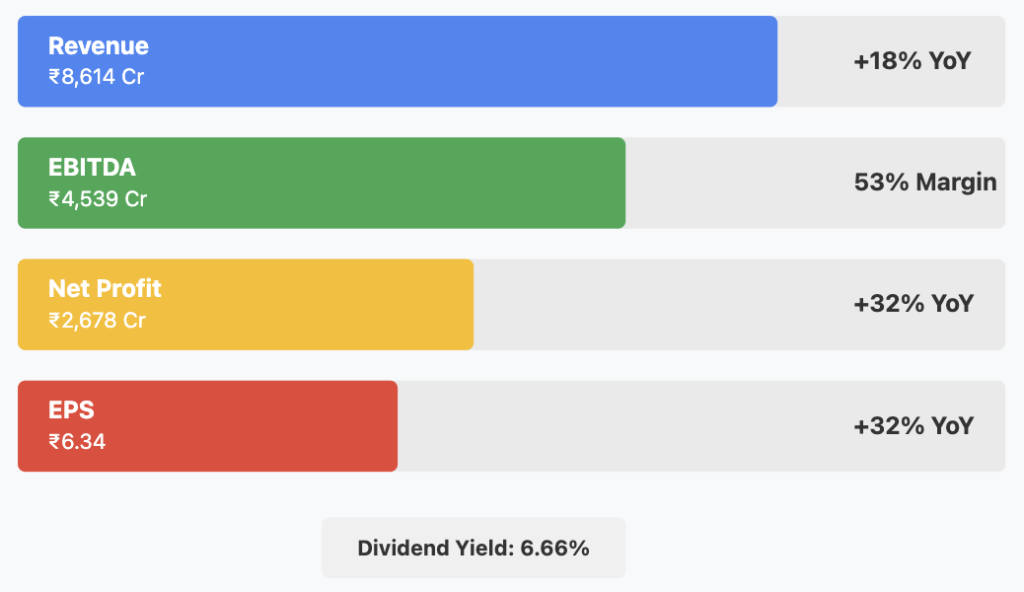

Hindustan Zinc Limited delivered an impressive Q3 FY25 Results performance, demonstrating robust growth across key financial metrics. As India’s largest and only integrated producer of zinc, lead, and silver, the company reported a 18% year-over-year revenue increase to ₹8,614 crore, while net profit surged by 32% to ₹2,678 crore. This strong performance was driven by record mined and refined metal production, operational efficiencies, and favorable input cost trends. With a substantial dividend yield of 6.66% and consistent AAA credit ratings, Hindustan Zinc continues to offer an attractive combination of growth and income potential for investors.

📌 Detailed Quarterly Results Breakdown

🔹 Consolidated Total Revenue: ₹8,614cr (↑18% year-over-year change)

Revenue exceeded expectations due to higher production volumes and improved market conditions, showing consistent growth momentum with a 4% quarter-over-quarter increase.

🔹 Operating EBITDA (Earnings Before Interest, Tax, Depreciation & Amortization): ₹4,539cr (↑significant year-over-year change)

Impressive margin expansion to approximately 53%, representing a ~400 basis points improvement year-over-year, reflecting operational efficiencies.

🔹 Net Profit After Tax: ₹2,678cr (↑32% year-over-year change)

Profit growth outpaced revenue growth, driven by improved operational performance and cost optimization initiatives, with a strong 15% quarter-over-quarter increase.

🔹 Diluted Earnings Per Share: ₹6.34 (↑32% year-over-year change)

EPS growth directly mirrors the net profit growth, providing substantial value creation for shareholders.

📈 Comprehensive Growth Analysis:

🔹 Sequential Revenue Growth (Quarter-over-Quarter): 4% | Annual Revenue Growth (Year-over-Year): 18%

The company maintains strong growth momentum despite market fluctuations, demonstrating resilience and operational strength.

🔹 Sequential Profit Growth (Quarter-over-Quarter): 15% | Annual Profit Growth (Year-over-Year): 32%

Profit growth significantly outpaces revenue growth, indicating improving operational leverage and cost efficiencies.

🔹 Business Volume/Order Book Growth: Record production levels achieved

Record mined and refined metal production driven by higher ore grades and plant availability point to strong future revenue visibility.

🔹 Profitability Margin Trend: Improving

EBITDA margins expanded by approximately 400 basis points year-over-year to reach ~53%, highlighting the company’s ability to enhance profitability even amid challenging market conditions.

💰 Operational Cost Structure Analysis:

🔹 Raw Material/Input Costs: Declining trend

Cost of Production (COP) for zinc reduced by 5% year-over-year due to improved efficiencies and favorable input cost trends, enhancing overall margin profile.

🔹 Employee/Personnel Expenses: Stable relative to revenue growth

Operational efficiencies have allowed personnel costs to remain well-managed despite production increases.

🔹 Finance/Interest Expenses: Minimal impact

The company’s strong AAA credit rating and robust cash flow generation have kept financing costs low, contributing to improved bottom-line performance.

✅ Bull Case & Bear Case Thesis:

🔍 Long-term Financial Health Indicators:

🔹 5-Year Compound Annual Growth Rate: Revenue CAGR potential: 10-12% | Net Profit CAGR potential: 10-12%

🔹 Return on Capital Employed (ROCE): 46.2% vs Industry Average: Significantly higher

🔹 Debt-to-EBITDA Ratio: Low | Free Cash Flow Conversion Rate: Strong at ₹2,628cr pre-capex

🔹 Promoter Shareholding Pattern: Stable

🏗️ Strategic Capital Allocation & Future Growth Roadmap:

🔹 Planned Capital Expenditure Budget: Significant allocation for capacity expansion

Funding directed toward underground mining expansion and smelter operations scaling to reach designed capacity of 1,123 ktpa.

🔹 Strategic Investment Focus Areas: Underground mining expansion and exploration to add 40 Mt Ore by FY25, extending mine life beyond 25 years and securing long-term production capabilities while enhancing sustainability credentials.

🔹 Production/Service Capacity Expansion Plans: Scaling smelter operations to designed capacity of 1,123 ktpa

This expansion aims to strengthen the company’s market position and ability to meet growing demand.

📊 Multi-Decade Growth Trajectory Projections:

- 5-Year Horizon (FY25-FY30): Base Case 10% CAGR | Bull Case 12% CAGR → Capacity expansion and operational efficiencies driving sustained growth in production volumes and revenue.

- 10-Year Horizon (FY25-FY35): Base Case 8% CAGR | Bull Case 10% CAGR → Continued market leadership in zinc production supported by expanded asset base and product diversification.

- 15-Year Horizon (FY25-FY40): Base Case 7% CAGR | Bull Case 9% CAGR → Sustained growth through technology integration and maintaining cost leadership in global markets.

- 20-Year Horizon (FY25-FY45): Base Case 6% CAGR | Bull Case 8% CAGR → Long-term value creation through resource expansion and strategic market positioning.

- 25-Year Horizon (FY25-FY50): Base Case 5% CAGR | Bull Case 7% CAGR → Leveraging extended mine life of 25+ years to maintain growth trajectory and market dominance.

💸 Current Valuation Analysis & Fair Value Assessment:

🔹 Current Price-to-Earnings Ratio: 19.6 compared to 5-Year Historical Average: Moderate

🔹 Enterprise Value to EBITDA Multiple: Attractive compared to Sector Average

🔹 Estimated Fair Value Range: ₹470-₹520 based on DCF analysis with moderate growth assumptions

This represents approximately 8-20% potential upside from the current price of ₹435, with additional value from the substantial dividend yield.

Management Commentary & Conference Call Highlights

The management highlighted their commitment to operational excellence, emphasizing that the record production levels achieved during the quarter demonstrate the success of their efficiency initiatives. They also reaffirmed their focus on sustainability, positioning Hindustan Zinc as Asia’s first low-carbon “green” zinc producer. The expansion of underground mining capabilities and aggressive exploration plans were presented as key drivers for extending mine life beyond 25 years, providing a solid foundation for long-term growth.

Technical Analysis & Chart Patterns

Hindustan Zinc’s stock is currently trading at ₹435, within a broader trading range of ₹289-₹808. The stock appears to be consolidating after recent gains, with key support levels at ₹400 and resistance at ₹460. The current technical setup suggests a potential for continued upward momentum if the stock breaks above the ₹460 resistance level, supported by strong fundamental performance.

Industry Context & Competitive Positioning

As India’s largest and only integrated producer of zinc, lead, and silver, Hindustan Zinc holds a dominant market position with over 75% share in India’s primary zinc market. This quarter’s results further reinforce its competitive advantage through cost leadership, with zinc production costs declining by 5% year-over-year. The company’s positioning in the growing renewable energy sector, particularly for zinc applications in solar panel protection and battery storage, provides additional growth catalysts compared to peers. Its commitment to sustainability and status as Asia’s first low-carbon “green” zinc producer also differentiate it in an increasingly ESG-conscious market.

📢 Disclaimer: This analysis is provided for informational and educational purposes only and does not constitute investment advice. The author may hold positions in securities discussed. Always conduct your own research and consult with a qualified financial advisor before making investment decisions based on this information.

If you found this analysis valuable, please consider:

- Sharing this newsletter with colleagues interested in Indian equity markets

- Subscribing to receive future in-depth analyses of Indian companies

- Leaving a comment with your thoughts on Hindustan Zinc’s quarterly performance

#IndiaInvesting #Metals #NSE #StockMarket #GrowthStocks #QuarterlyResults #FinancialAnalysis