Company Overview

Introduction

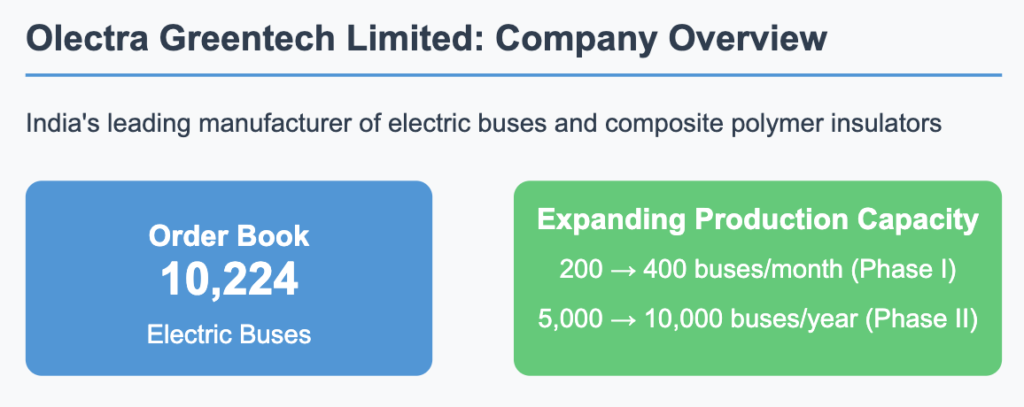

Olectra Greentech Limited stands at the forefront of India’s electric vehicle revolution as the country’s leading manufacturer of electric buses and composite polymer insulators. With a robust order book of 10,224 electric buses and aggressive capacity expansion plans, Olectra is strategically positioned to capitalize on India’s growing commitment to sustainable transportation solutions. This report analyzes the company’s Q3 FY2025 performance, growth trajectory, and long-term investment potential.

Q3 FY2025 Financial Performance

Q3 FY2025 Financial Performance

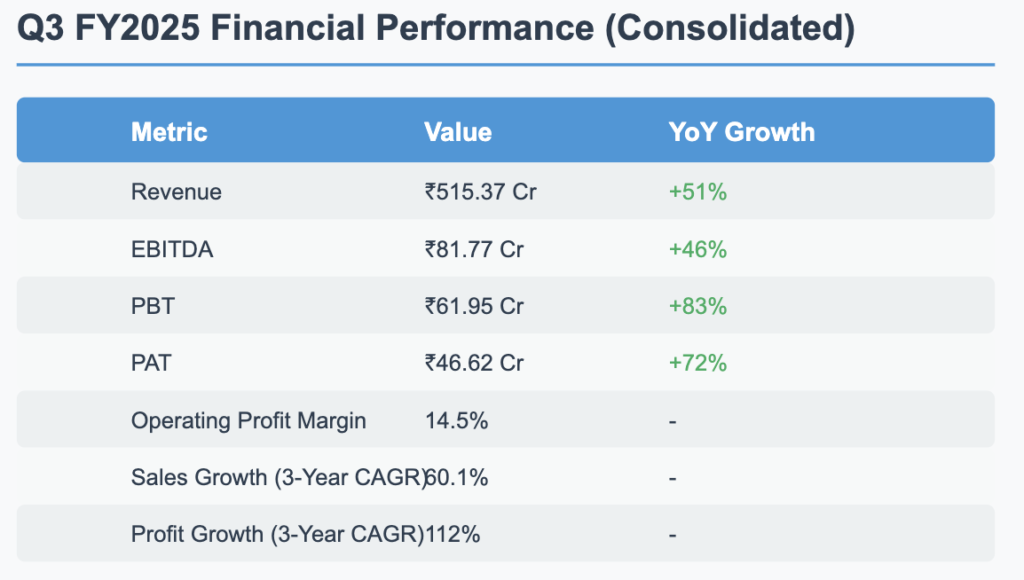

Olectra Greentech delivered an exceptional financial performance in Q3 FY2025, demonstrating the company’s strong growth momentum and increasing market dominance in the electric bus segment. The company reported consolidated revenue of ₹515.37 crore, representing a robust year-over-year growth of 51%. This performance was primarily driven by increased deliveries in the EV division, which contributed ₹459.78 crore to the total revenue, while the Insulator division added ₹4.7 crore.

Profitability metrics showed significant improvement, with EBITDA reaching ₹81.77 crore (+46% YoY) and PAT soaring to ₹46.62 crore (+72% YoY). The company maintained a healthy operating profit margin of 14.5%, indicating efficient cost management despite rapid expansion. The impressive three-year CAGR of 60.1% for sales and 112% for profits underscores Olectra’s consistent execution and growing market acceptance of its products.

Growth Plans & Expansion

Growth Plans & Expansion

Capacity Expansion

Olectra Greentech is embarking on an ambitious capacity expansion program to meet the growing demand for electric buses in India. The expansion is structured in two phases:

- Phase-I: Increasing production capacity from 200 to 400 buses per month

- Phase-II: Enabling production of 5,000 buses annually, with plans to further scale up to 10,000 buses per year

To fund this expansion, the company is investing ₹750 crore in capital expenditure, financed through a combination of ₹500 crore in debt and internal accruals. This strategic investment will significantly enhance Olectra’s manufacturing capabilities, allowing it to efficiently execute its growing order book.

Technology Innovation

Olectra is not just expanding capacity but also investing in cutting-edge technology to maintain its competitive edge:

- Blade Battery Technology: The company has introduced this advanced battery technology to improve energy efficiency, safety features, and charging speed of its electric buses.

- Battery Energy Storage Systems (BESS): Exploring investments in BESS represents a forward-looking approach to diversify its product portfolio and address the broader energy storage market.

Order Book & Execution Strategy

Order Book & Execution Strategy

With a substantial backlog of 10,224 electric buses, Olectra has a clear visibility of future revenue. The company has set ambitious delivery targets of 1,200 buses in FY25 and 2,500 buses in FY26. The commissioning of new manufacturing facilities is strategically timed to ensure seamless execution of both existing and upcoming orders, mitigating potential production bottlenecks.

Future Financial Projections & Returns

Future Financial Projections

Short-Term (1-3 Years)

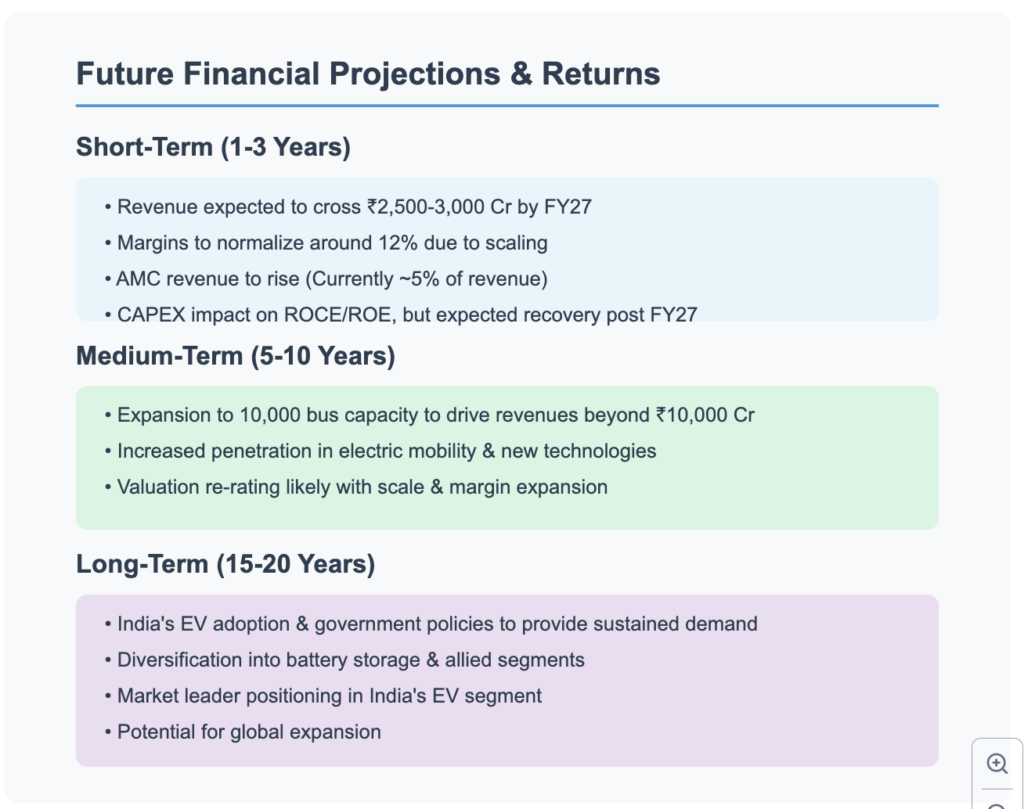

Olectra is positioned for substantial growth in the near term, with revenue projected to exceed ₹2,500-3,000 crore by FY27. While operating margins are expected to normalize around 12% due to scaling effects, the company’s Annual Maintenance Contract (AMC) revenue stream is anticipated to grow from its current level of approximately 5% of total revenue.

The significant CAPEX investment may temporarily impact return metrics like ROCE and ROE; however, these are expected to recover post-FY27 as the new capacity begins to generate sustainable returns.

Medium-Term (5-10 Years)

The medium-term outlook is particularly promising, with the expansion to 10,000 bus manufacturing capacity driving annual revenues beyond ₹10,000 crore. Increased penetration in the electric mobility sector, coupled with diversification into new technologies like BESS and charging infrastructure, will create multiple growth avenues.

As the company achieves scale and potentially expands its margins, a valuation re-rating is likely, providing substantial returns to long-term investors.

Long-Term (15-20 Years)

The long-term investment thesis for Olectra is underpinned by India’s accelerating EV adoption trajectory and supportive government policies. The company is strategically positioning itself to benefit from these secular trends through:

- Diversification into battery storage and allied segments

- Cementing its market leadership in India’s EV segment

- Exploring potential global expansion opportunities

Key Metrics & Valuation Analysis

Key Metrics & Valuation

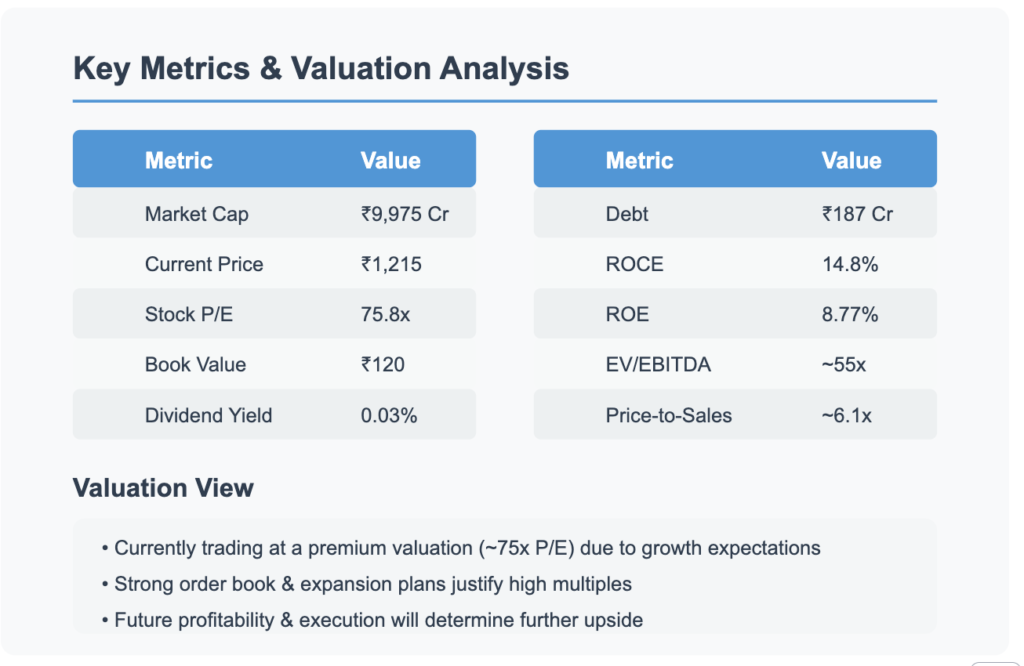

Olectra Greentech currently trades at premium valuations, with a P/E ratio of 75.8x and an EV/EBITDA multiple of approximately 55x. These elevated multiples reflect the market’s optimistic outlook on the company’s growth potential in the rapidly expanding electric mobility sector. Key financial metrics include:

- Market Capitalization: ₹9,975 crore

- Current Price: ₹1,215

- Book Value: ₹120

- Debt: ₹187 crore (planned increase by ₹500 crore for CAPEX)

- ROCE: 14.8%

- ROE: 8.77%

- Price-to-Sales Ratio: ~6.1x

- Dividend Yield: 0.03% (low payout as the company prioritizes reinvestment for growth)

While the valuation appears stretched by conventional metrics, the strong order book and ambitious expansion plans provide a significant runway for growth that could justify these premium multiples. However, future performance will heavily depend on successful execution of capacity expansion and maintaining profRetry

Claude hit the max length for a message and has paused its response. You can write Continue to keep the chat going.

Risks & Challenges

Risks & Challenges

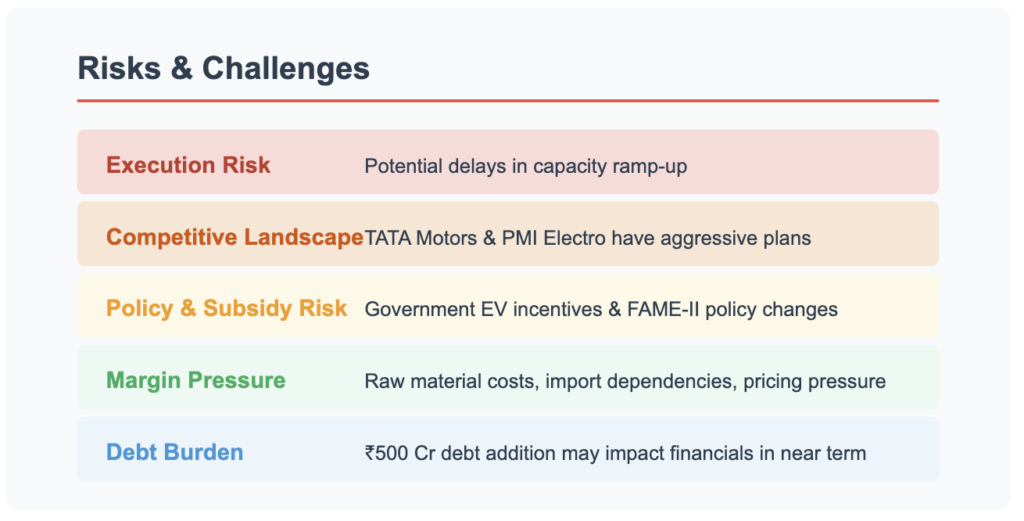

While Olectra Greentech presents a compelling growth story, investors should be mindful of several key risks:

- Execution Risk: The ambitious capacity expansion plan could face delays or cost overruns, potentially affecting delivery timelines for the large order book.

- Competitive Landscape: Major players like TATA Motors and PMI Electro are aggressively expanding their electric bus portfolios, which could intensify pricing pressure and competition for new orders.

- Policy & Subsidy Risk: Changes in government EV incentives or FAME-II policy could impact demand dynamics and profitability.

- Margin Pressure: Fluctuations in raw material costs, import dependencies for critical components, and competitive pricing pressure could constrain margins.

- Debt Burden: The addition of ₹500 crore in debt for CAPEX could temporarily strain the balance sheet and impact near-term financial metrics.

Credit Rating & Dividend Outlook

Olectra Greentech has not reported any significant changes in its credit rating. The company maintains a conservative dividend policy with a yield of just 0.03%, as it prioritizes reinvesting capital into its growth initiatives rather than distributing profits to shareholders.

Investment Decision Summary

Investment Decision Summary

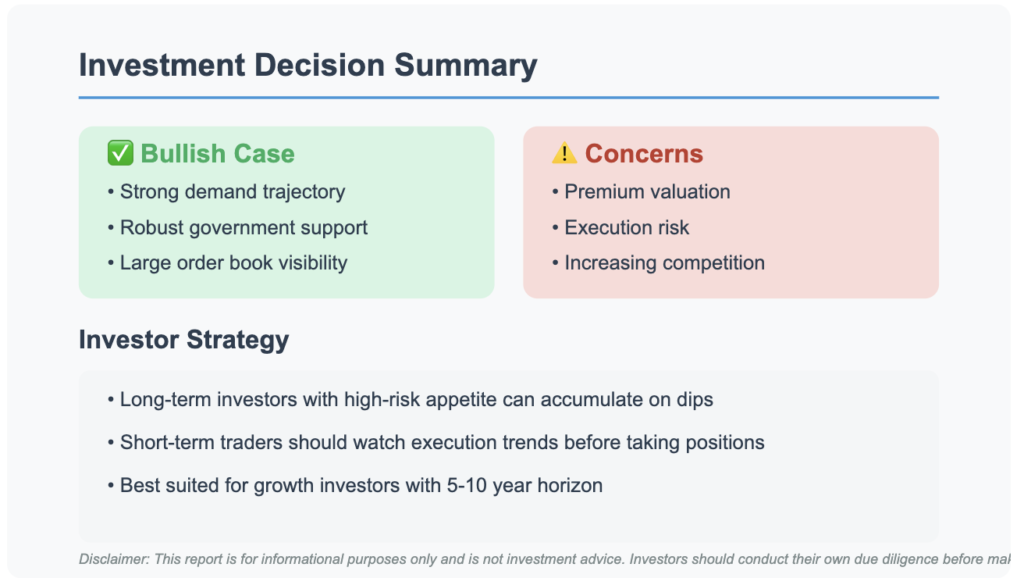

Bull Case

- Olectra is riding the strong demand wave for electric buses in India, supported by favorable government policies and initiatives

- The substantial order book of 10,224 buses provides excellent revenue visibility

- Technology innovations and capacity expansion position the company for sustainable long-term growth

- First-mover advantage in a rapidly growing market segment

Bear Case

- The current valuation (75.8x P/E) is at a significant premium and may not be sustainable if execution falters

- Planned debt addition of ₹500 crore could strain near-term financials

- Increasing competition from established players like TATA Motors could pressure margins

- Dependency on government policies and subsidies creates regulatory risk

Investor Strategy

Olectra Greentech represents an attractive investment opportunity for growth-oriented investors with a 5-10 year time horizon and high-risk tolerance. The company’s positioning in India’s rapidly expanding electric mobility sector, coupled with its strong order book and expansion plans, provides a solid foundation for long-term growth.

- Long-term investors with high-risk appetite can consider accumulating positions on market dips

- Short-term traders should closely monitor execution trends and quarterly delivery numbers before establishing positions

- Income-focused investors may find the stock less attractive due to its minimal dividend yield (0.03%)

The stock is best suited for portfolio allocation in the high-growth, high-risk segment, with investors prepared to weather potential volatility as the company executes its ambitious expansion plans.

Conclusion

Olectra Greentech Limited stands at an inflection point in its growth journey, with Q3 FY2025 results highlighting its accelerating momentum in India’s electric bus market. The company’s aggressive capacity expansion, technological innovations, and robust order book position it favorably to capitalize on the structural shift toward sustainable transportation solutions in India.

While the premium valuation reflects high growth expectations, successful execution of the capacity expansion plan and maintaining healthy margins will be critical to delivering shareholder value. Investors with a long-term horizon and appetite for growth stocks should consider Olectra Greentech as a potential beneficiary of India’s electric mobility revolution.

Disclaimer: This report is for informational purposes only and is not investment advice. Investors should conduct their own due diligence before making investment decisions.

Leave a Reply

You must be logged in to post a comment.