Latest Q4 FY2025 Results Overview

Anant Raj Limited, a key player in India’s real estate development sector, has released its audited financial results for the quarter and year ended March 31, 2025. The company has showcased robust growth in revenue and profitability, underpinned by its strategic focus on real estate projects, particularly in the National Capital Region (NCR). This report analyzes the company’s financial metrics, recent developments, and future outlook to provide investors with a comprehensive view of its investment potential.

Financial Performance

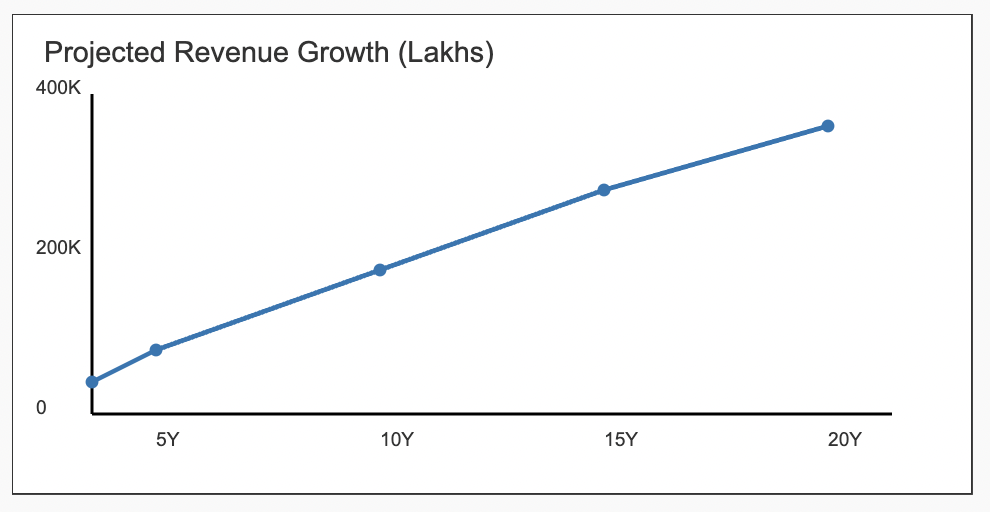

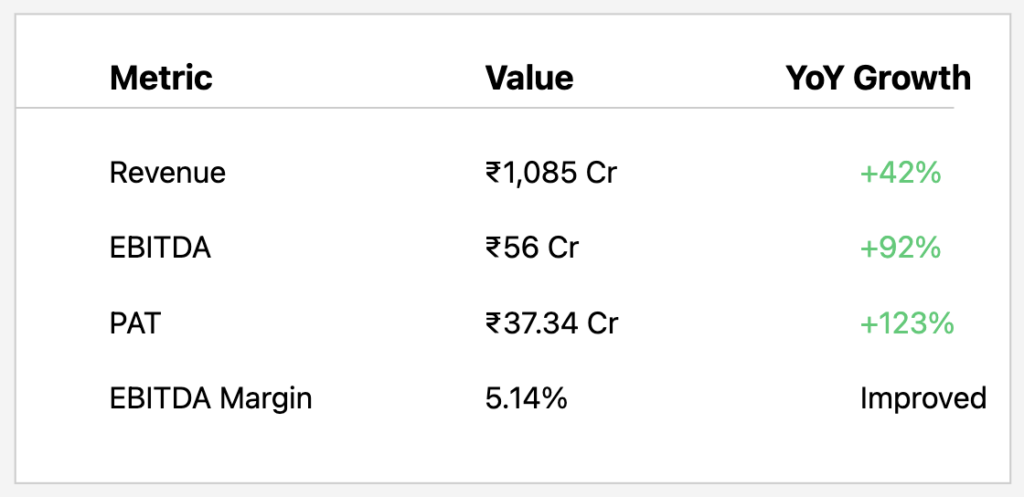

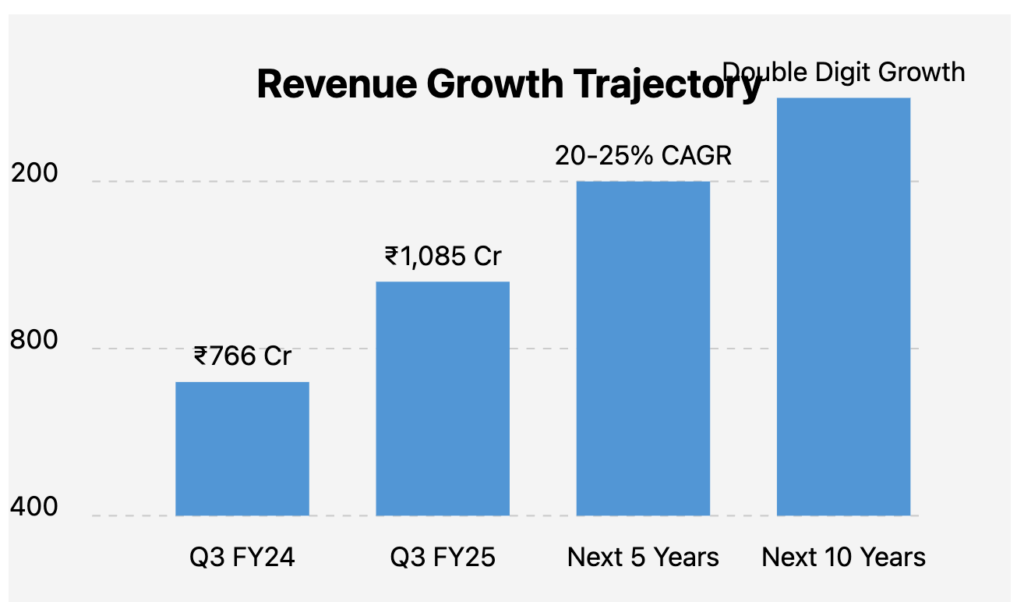

For FY 2024-25, Anant Raj Limited reported consolidated revenue from operations of ₹2,060 Cr., reflecting a strong year-on-year sales growth of 38.9%. The profit after tax (PAT) reached ₹426 Cr., up by an impressive 63.1% from the previous year. Over the past three years, the company has achieved a compounded sales growth of 64.6% and a profit growth of 100%, highlighting its ability to scale operations and enhance profitability consistently.

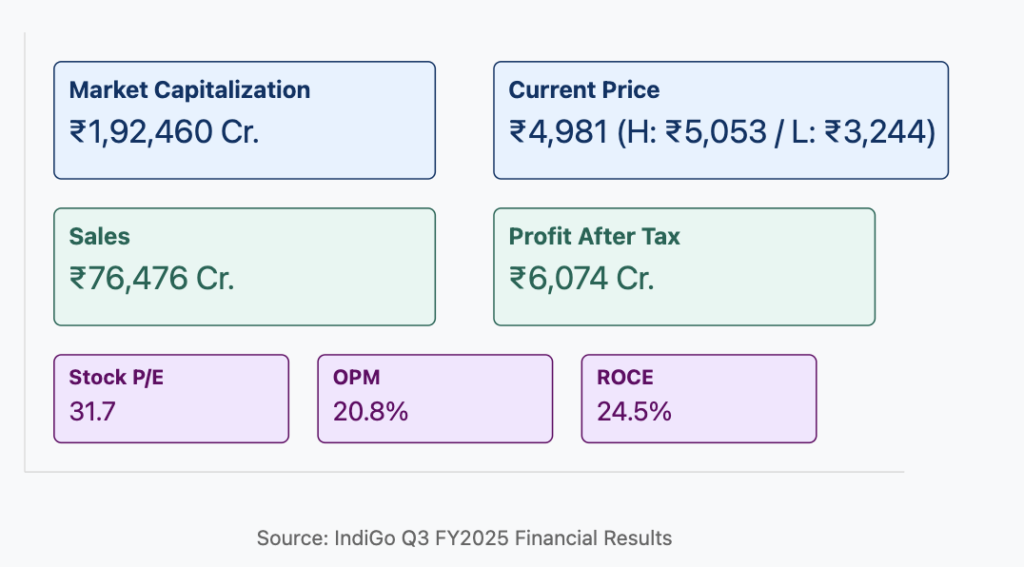

Key Financial Metrics

Here’s a snapshot of the company’s critical financial indicators:

- Market Capitalization: ₹17,359 Cr.

- Current Stock Price: ₹506

- 52-Week High/Low: ₹948 / ₹319

- Price-to-Earnings (P/E) Ratio: 40.8

- Book Value per Share: ₹121

- Price-to-Book (P/B) Ratio: ~4.18 (calculated as ₹506 / ₹121)

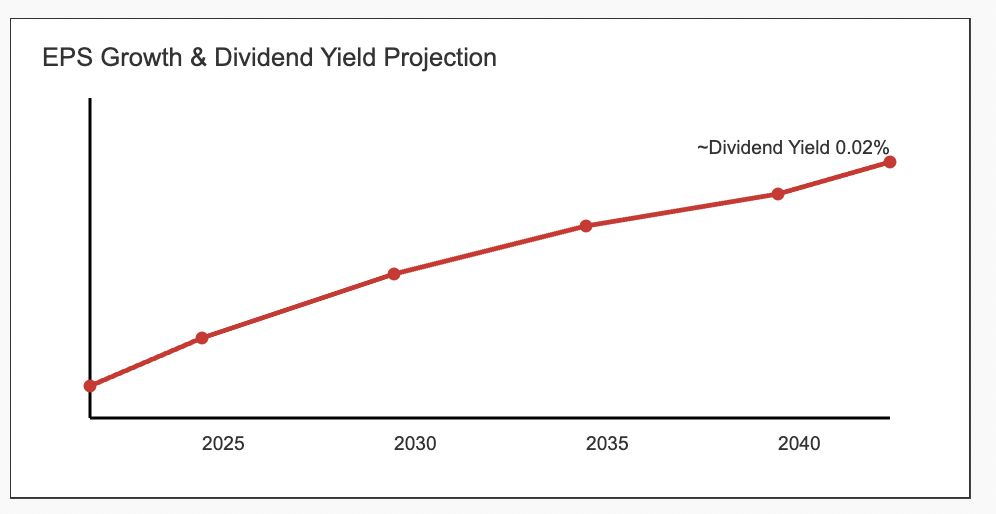

- Dividend Yield: 0.14%

- Return on Capital Employed (ROCE): 11.2%

- Return on Equity (ROE): 10.9%

- Operating Profit Margin (OPM): 23.9%

- Debt: ₹482 Cr.

- Reserves: ₹4,092 Cr.

- Debt-to-Equity Ratio: 0.12 (calculated as ₹482 Cr. / ₹4,160.6 Cr., where equity = ₹68.6 Cr. paid-up capital + ₹4,092 Cr. reserves)

- Promoter Holding: 60.2% (with a 3-year change of -4.83%)

- Number of Equity Shares: 34.3 Cr.

- Face Value: ₹2.00

Analysis

Growth and Profitability: Anant Raj Limited has demonstrated exceptional growth, with a 38.9% increase in sales and a 63.1% rise in PAT in FY 2024-25. The OPM of 23.9% is notably strong for the real estate sector, reflecting efficient cost management and solid project execution. The 3-year profit variation of 100% further underscores the company’s ability to double its earnings, a testament to its operational success.

Valuation: The stock trades at a P/E ratio of 40.8, which is elevated compared to industry averages, suggesting that the market anticipates significant future growth. However, the P/B ratio of 4.18 indicates that the stock is priced at a premium relative to its book value, potentially signaling overvaluation or high investor confidence in its assets and growth trajectory.

Balance Sheet Strength: With debt of ₹482 Cr. against reserves of ₹4,092 Cr., the company maintains a low debt-to-equity ratio of 0.12, indicating a conservative capital structure and minimal financial risk. This strong balance sheet provides flexibility for future expansion or weathering industry downturns.

Stock Performance: The stock’s 52-week range of ₹319 to ₹948 reflects significant volatility, offering opportunities for traders but also highlighting risks. At ₹506, it sits below its yearly high, potentially appealing to value-seeking investors.

Promoter Confidence: Promoter holding stands at 60.2%, a solid vote of confidence, though a -4.83% change over three years may raise questions about long-term commitment, warranting close monitoring.

Dividend Announcement

The Board has recommended a final dividend of 36.5%, translating to Re. 0.73 per equity share (face value ₹2), pending shareholder approval at the upcoming Annual General Meeting. While the dividend yield of 0.14% is modest, it signals a commitment to rewarding shareholders, albeit with a focus on reinvesting profits for growth.

Capital Raising and Debt Management

- Equity Issuance: The company raised ₹99.99 Cr. by issuing 13,69,863 equity shares at ₹730 each through the conversion of warrants to a promoter group entity. The funds have been utilized as planned, with no reported deviations.

- Debt Reduction: Anant Raj redeemed ₹116.50 Cr. worth of non-convertible debentures in FY 2024-25, further strengthening its financial position.

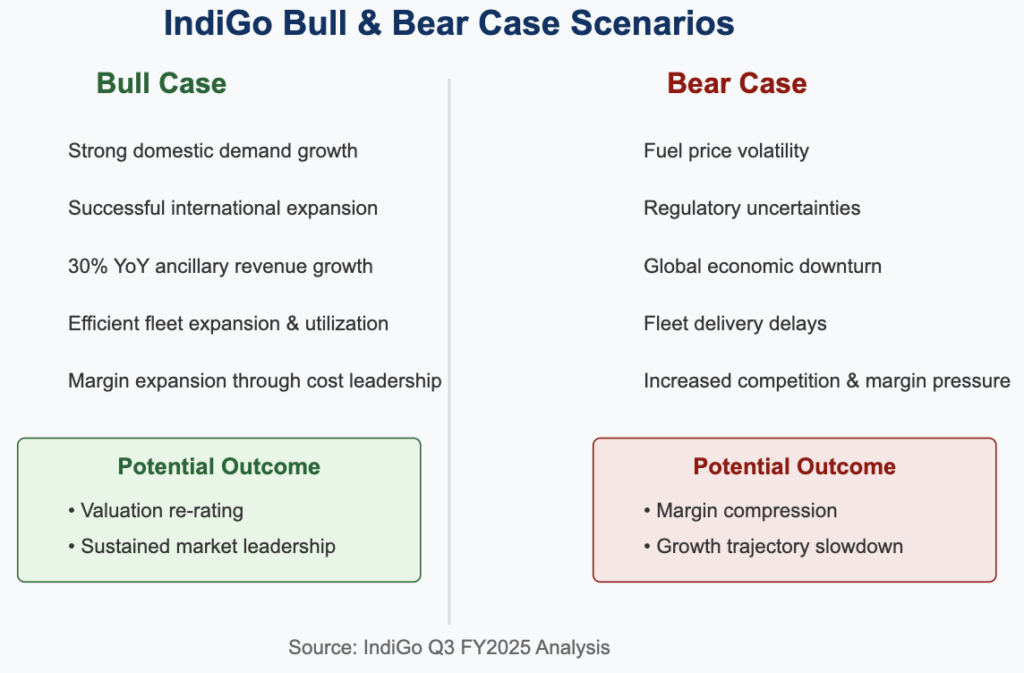

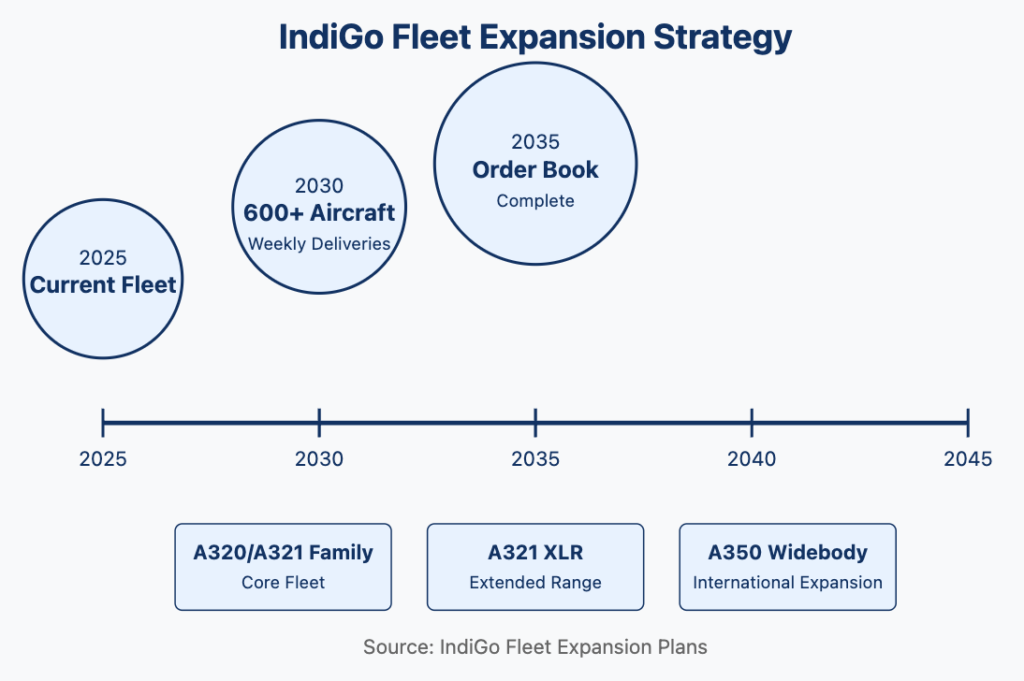

Outlook

Anant Raj Limited is well-positioned for continued growth, leveraging its strong presence in the NCR’s real estate market, where demand for residential and commercial properties remains robust. The company’s low leverage, high profitability, and consistent growth make it a compelling option in the sector. However, challenges such as the real estate industry’s cyclicality, regulatory risks, and the stock’s high valuation multiples require careful consideration.

Recommendation

For long-term investors, Anant Raj Limited offers a solid growth story backed by strong fundamentals. However, given the high P/E of 40.8, it may be prudent to accumulate on price dips or await a more favorable entry point to mitigate valuation risks. Short-term traders could capitalize on the stock’s volatility, while dividend-focused investors may find the yield less attractive.

Disclaimer: This report is for informational purposes only and does not constitute investment advice. Investors should conduct their own research or consult a financial advisor before making decisions.