Executive Summary

D.P. Abhushan Limited has emerged as a standout performer in the Indian jewelry market, delivering exceptional financial results in Q3 FY25. With a strategic focus on high-margin wedding and diamond jewelry, the company demonstrates robust growth potential and a compelling investment narrative.

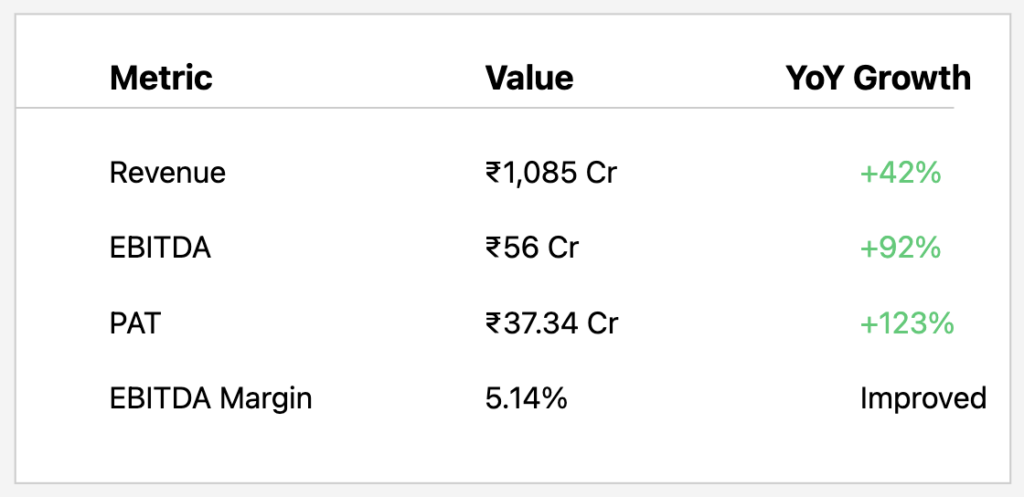

Q3 FY25 Financial Performance Highlights

Key Financial Metrics

- Revenue: ₹1,085 crores (42% YoY growth)

- EBITDA: ₹56 crores (92% YoY growth)

- PAT: ₹37.34 crores (123% YoY growth)

- EBITDA Margin: 5.14%

- PAT Margin: 3.4%

Revenue Composition

- Gold Jewelry: 93%

- Diamond Jewelry: 5%

- Silver Jewelry: 2%

Growth Strategy and Expansion Plans

Store Network Expansion

The company aims to:

- Double company-owned store network in 2-3 years

- Open approximately 10 new stores in Tier 2 and Tier 3 cities

- Target regions: Madhya Pradesh, Rajasthan, Gujarat, Chhattisgarh, potential expansion to UP/Bihar

Funding Strategy

- Planned Qualified Institutional Placement (QIP)

- Raise up to ₹600 crores

- Primary allocation: Inventory funding and new showroom development

Financial Ratios and Metrics

- P/E Ratio: 28.7

- ROCE: 27.1%

- ROE: 29.5%

- Market Capitalization: ₹2,979 crores

- Debt/Reserves: ₹186 crores / ₹315 crores

- Promoter Holding: 73.8%

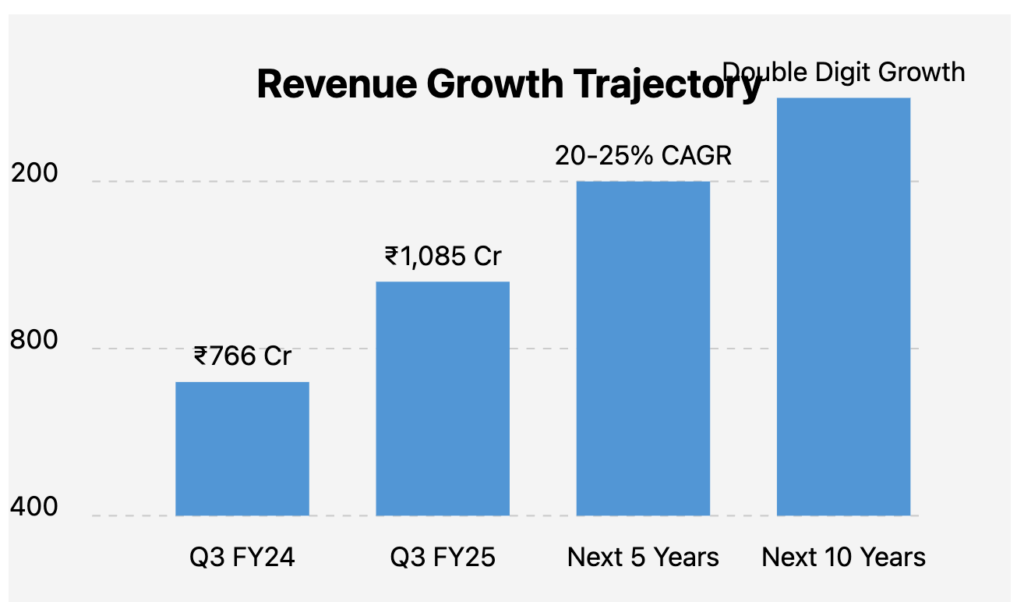

Long-Term Growth Projections

Revenue Growth Outlook

- Management Guidance: 20-25% growth in next fiscal year

- 9-month results show growth up to 45%

- Potential growth scenarios:

- 5-year horizon: High single-digit growth

- 10-year horizon: Low double-digit growth

- 15-20 year horizon: Substantial market share expansion

Strategic Competitive Advantages

- Focus on high-margin product segments

- Customized, ethically sourced jewelry

- Efficient logistics and geographic proximity of stores

- Potential margin improvement of 20-25% in coming years

Risk Factors

- Gold Price Volatility

- Execution Risk in Store Expansion

- Increasing Market Competition

- Potential Margin Pressure

Valuation Considerations

- Current P/E Ratio: 28.7

- Reflects market growth expectations

- No significant credit rating changes mentioned

- Strong balance sheet with moderate debt

Investment Thesis

Bull Case

- Rapid store expansion

- Growing organized jewelry market

- Strong margin improvement potential

- Capturing share of ₹10 lakh crore Indian wedding market

Bear Case

- Commodity price fluctuations

- Execution challenges in new markets

- Increasing competitive pressures

Conclusion

D.P. Abhushan Limited presents a compelling investment opportunity in the Indian jewelry market, backed by strong financial performance, strategic expansion, and a focus on high-margin product segments.

Disclaimer: This analysis is for informational purposes only. Investors should conduct independent research and consult financial advisors before making investment decisions.

Leave a Reply

You must be logged in to post a comment.