Analyst: Top‑Tier Equity Research (April 2025)

ICICI Bank Ltd reported its Latest Q4 FY2025 Results, with key performance drivers including strong business banking loan growth (+31.9% YoY) and robust fee income growth (+16.3% YoY) . The investor presentation highlighted healthy capital buffers (CET1 15.93%) and a lean cost structure (standalone cost‑to‑income ~38.5%) . The confcall transcript provided insights into stable credit costs (37 bps of advances) and the roll‑out of digital platforms (DigiEase for business banking, iLens for retail lending) .

Future Growth Plans

- Technology & Digitalisation: Continued investments in digital channels, data analytics and back‑end automation to simplify processes.

- 360° Customer Engagement: Deepening relationships across ecosystems and micro‑markets through holistic solutions.

Planned Expansions

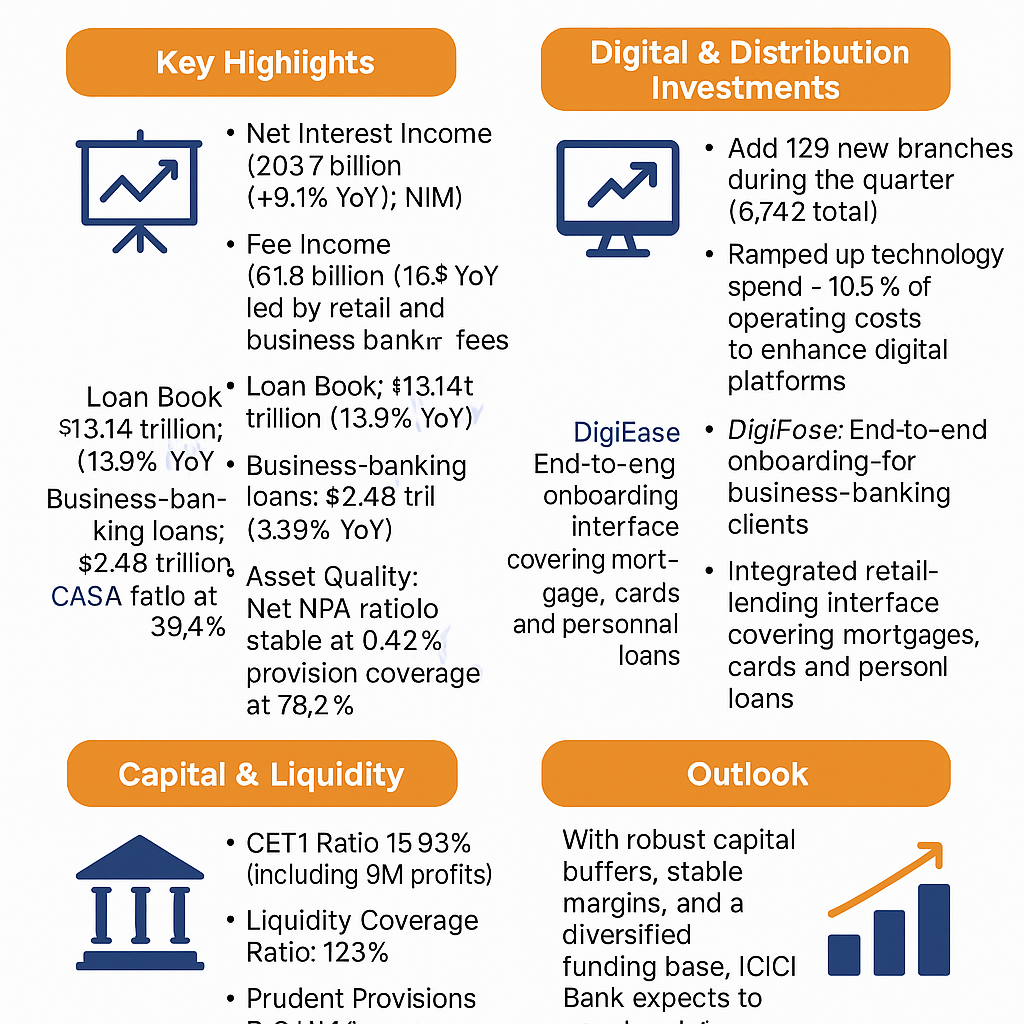

- Branch Network: Added 129 branches in Q3 (219 in 9M) to extend physical reach .

- Rural Outreach: Leveraging partnerships and micro‑finance schemes to grow the rural portfolio.

Future Financial Projections

Management targets mid‑teens CAGR in both revenues and profits over the next few years, driven by sustained loan growth (~14–16% p.a.) and diversified non‑interest income. Long‑term returns (5‑20 years) will hinge on execution of digital initiatives, macro‑economic stability, and regulatory developments.

Latest Results Highlights

- Profit After Tax: ₹117.92 bn; +14.8% YoY .

- Net Interest Income: ₹203.71 bn; +9.1% YoY; NIM 4.25% .

- Asset Quality: Net NPA ratio 0.42%; Provision coverage 78.2% .

Key Metrics

- Loan Book: +13.9% YoY; Retail ₹7.03 tn (+10.5%); Business Banking ₹2.48 tn (+31.9%) .

- Fee Income: ₹61.80 bn; +16.3% YoY .

- ROE: 19.9%; ROCE: 8.43%; Dividend Yield: 0.71%.

CAPEX & Growth Strategy

- Tech Spend: Technology expenses ~10.5% of opex to build digital platforms and strengthen resilience .

- Network Expansion: Balanced branch additions alongside digital self‑service investments.

Management Updates

- Governance & Risk: Emphasis on “Fair to Customer, Fair to Bank” and “Return of Capital.”

- Liquidity: LCR at 123%; strong deposit franchise (CASA ~39%) .

Long‑Term Projections

- RoE Sustainability: Aim to sustain RoE near 18–20% through calibrated growth and cost efficiencies.

- Fee Income Leverage: Higher wallet share via digital channels to boost non‑interest revenues.

Valuation

- P/E: 19.6× vs five‑year average ~17×—premium reflects superior franchise, capital strength, and consistent execution .

Credit Agency Rating Changes

- No changes in long‑term ratings; Moody’s Baa3 / S&P BBB‑; domestic ratings AAA / AAA+ reaffirmed.

Conclusion

ICICI Bank’s Q3 FY2025 performance underscores its resilient growth, strong asset quality, and prudent capital management, positioning it well for sustained value creation amid evolving macro conditions.

Disclaimer: This report is for informational purposes only and does not constitute investment advice. Investors should conduct their own analysis before making any investment decisions.

Leave a Reply

You must be logged in to post a comment.